The White House argues that stimulus from Mr. Biden’s infrastructure and social spending legislation would trickle out over time and could improve economic capacity, relieving supply chain pressures over the longer run. But the administration and Fed alike are watching closely to make sure that consumers do not come to expect ever-higher prices amid today’s burst in inflation.

“The real question is, when your boss says, ‘Hey, I’m giving you a 4 percent raise this year,’ are you happy or upset?” Mr. Levy, the Flexport economist, said. “Once that stuff gets built in, it can be very painful to change.”

Encouragingly, consumer and financial market expectations of where inflation will settle over the longer term — typically five years — seem to have leveled off after climbing slightly earlier in 2021. Still, companies are planning for the possibility that supply chain disruptions and rising costs will persist for some time.

“We’re not expecting supply chain pressures to ease,” Mark J. Tritton, chief executive officer at Bed Bath & Beyond, said during an earnings call on Friday. He noted that the company was trying to adjust how it operated to deal with the issues, including by trying to carefully manage inventory.

General Motors and Honda both reported significant declines from a year earlier in sales during the three months that ended in September as chip shortages forced them to idle plants, leaving dealers with few vehicles to offer customers. And as used cars remain in short supply, their prices — a major driver of inflation this year — could rise again.

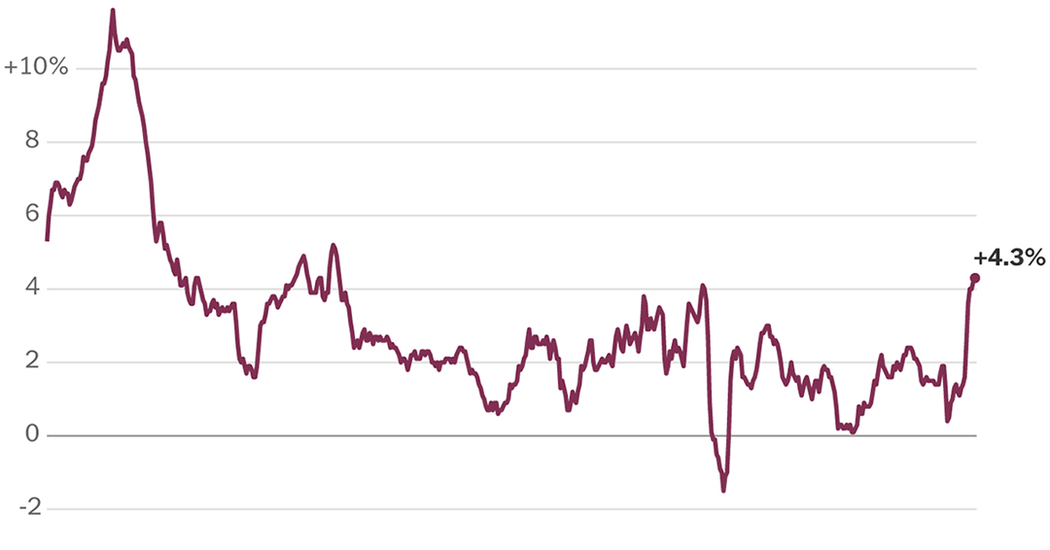

The pain is being felt across many advanced economies: Inflation in the eurozone climbed to 3.4 percent in September from a year earlier, the highest in 13 years, according to an estimate by the region’s statistical agency released on Friday.

Omair Sharif, founder of the research firm Inflation Insights, said he still expected U.S. price increases to fade to more normal levels by the middle of next year — but acknowledged that it was going to take longer to resolve supply problems than he would have expected even three months ago.

“We just had blinders on with the global supply chain,” he said.

Neal E. Boudette and Eshe Nelson contributed reporting.