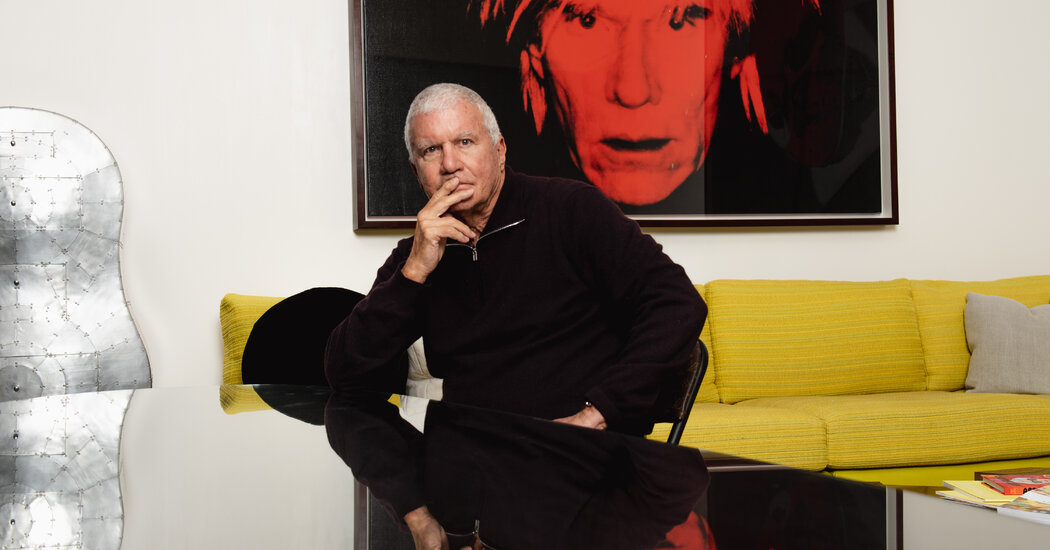

It is hard to imagine an art world without Larry Gagosian in it. The mega dealer, who started in the 1970s by selling posters on the street, represents some of the most important artists of our time (Cy Twombly, Helen Frankenthaler, Richard Prince), but has also come to symbolize — and set the tone — for a sexy gallery scene of museum-quality shows, glamorous exhibition openings and high prices.

While privately held, his company’s revenue is widely estimated at about $1 billion. As one collector put it, there are two people in the art world who require only a first name: Larry and Andy (as in Warhol).

But people in the art world have long wondered how Gagosian’s empire will survive without Gagosian himself. Every one of his 19 galleries in seven countries bears the stamp of his shrewd taste in art, his spare, elegant aesthetic. Gagosian is a strong — somewhat opaque and occasionally prickly — personality with clear opinions. A bachelor with no children, he turns 78 in 2023, raising the question of a succession plan.

Now Gagosian finally seems to be forming one. In the last year, he assembled a board of directors to help him think through the future of his business. In addition to seven of his key associates and Gagosian himself, the board features 12 outside members from various industries, all of them collectors. These include Evan Spiegel, the chief executive of Snap; the artist Jenny Saville; the financier J. Tomilson Hill, who is the chairman of the Guggenheim Museum; Glenn Fuhrman, a financier who founded the Flag Art Foundation; and Delphine Arnault, the executive vice president of Louis Vuitton who also serves on the executive committee of its parent company LVMH, run by her father Bernard Arnault, one of the world’s top collectors.

“I don’t know who will take over for me,” Gagosian said in an interview. “It’s tricky to have a legacy business, particularly when there’s no family. But we have an extremely successful business and we would like to see it live beyond me. This seemed like a step in that direction. I’m not contemplating stepping down or slowing down. It creates a model for the gallery to move forward and it also enriches it right now.”

Recently, talk has intensified around what a Gagosian Gallery enterprise will look like post-Gagosian. His peers in the field — David Zwirner, Hauser & Wirth, Pace, Acquavella, Nahmad — are family businesses, with a younger generation who could potentially succeed the founders.

Reports have also recently appeared in art publications, saying that Gagosian was for sale or considering an investment from LVMH or the Arnault family’s holding company.

The Fine Arts & Exhibits Special Section

Gagosian firmly denied these reports. “There is no conversation going on and I have no plans to sell the company,” he said. “I own 100 percent of it, I have no investors and my business is not for sale. I like to control what I’ve got.” At the same time, he said no company would responsibly exclude such a possibility down the line. “If somebody swooped in and wanted to make a major investment,” he said, “I think anybody would listen to that.”

As to how the new board will affect his concrete plans of succession, Gagosian said it will inform how he approaches the future. Precisely what form that future takes remains uncertain. Gagosian has several high-ranking deputies who help him run things already. None of his executives have emerged as a clear successor, although the veteran art dealer Andrew Fabricant, 67, whom Gagosian hired in 2018, now plays a leading role. (Gagosian called him “a great strategic thinker.”)

Gagosian said he has assembled the board as a kind of brain trust, with no specific mandate or end game, except to consider questions such as “What can you say about our business and more broadly the art market?” and “How do we move forward as a business? What are the challenges, what are the opportunities?”

During the early locked-down months of the coronavirus pandemic, Gagosian said he did some serious thinking about the longtime future of his business and how to let go a little more — although he added that he continues to work as hard as he’s ever worked.

Getting comfortable with delegating and working more collectively has been an acquired skill. “I resisted because maybe I’m a little more of a lone wolf — I’m a very entrepreneurial guy, I’m independent in my thinking,” Gagosian said. “But over the last few years it has given me more time to work on things I’m particularly interested in. I’m quite pleased to see how well the gallery functions. It’s taken a lot of stuff off my desk and given me time to work more conceptually and to spend more time with artists. It freed me up. I can’t imagine going back to the way it was before.”

Saville said she was happy to serve as the “artist’s voice” on the board.

“It’s very much about finding opportunities for artists, brainstorming about where art is moving,” she said. “I don’t know if other galleries have outlived their figure. The idea is to create something which gives the gallery a lot of longevity, with the beginning of a shape so it can live beyond Larry.”

The trustees, who are compensated, are expected to serve three-year terms, at which point they will rotate off unless Gagosian asks them to stay on. The board — which will meet twice annually — had its first meeting last May and the second one last week.

“It was a way to reach out to people in other areas, people who were insiders and people who were coming from a different perspective, and just kind of broaden the brain pool at the gallery,” Gagosian said. “It seemed like a great group of people that I’m comfortable with, that I already have friendships and relationships with. At the last meeting, we had to call it after about three and a half hours — people were still wanting to contribute more. From my perspective, it’s been very enriching.”

At the most recent board meeting, the members discussed what artists really want in a gallery, “what is an artist looking for?” Hill said. “What is a Stanley Whitney looking for or a Rick Lowe or a Jordan Wolfson — why would they go to Gagosian versus other galleries?”

The additional outside board members — all of them collectors — include the screenwriter and director Sofia Coppola and Dasha Zhukova Niarchos, an entrepreneur and investor.

“There is no question in my mind that when Larry is no longer, Gagosian Gallery will continue,” Hill said.

At the same time, the knowledgeable, hands-on “Larry” who Hill described working with over the last many years remains difficult to replicate.

“In the ’80s, I would go to his gallery because I’d always learn something,” Hill said. “And in the ’90s, I saw things I couldn’t believe I was seeing. My first exposure to Rubens oil sketches was a show Larry did of Rubens oil sketches.

“I bought my first Francis Bacon from him,” Hill continued, adding that he also bought his first Picasso, a painting of Picasso’s lover Marie-Thérèse, from Gagosian.

“I’d seen it in the retrospective of portraiture at the Museum of Modern Art,” he added. “It turned out it was owned by the actor Steve Martin. Steve, who had a great relationship with Larry, said ‘Larry, if you can find a buyer for this over the next week, I’ll sell it.’ That’s Larry.”