On Tuesday, the yield on the 10-year Treasury surged practically 10 foundation factors in a number of hours, rising above 4.49 p.c. The rising yield got here after the discharge of latest price-inflation knowledge displaying that CPI progress had hit a five-month excessive and remained properly above the Federal Reserve’s two-percent goal for worth inflation. Rising yields usually point out that bond buyers imagine worth inflation will proceed to develop, so it was most likely no coincidence that bond yields—particularly on longer-term bonds—jumped following the report’s launch.

In the meantime, dwelling costs continued to rise properly into mid 2025. This mix of rising dwelling costs and rising mortgage charges has made housing unaffordable for a rising share of propsective homebuyers.

In response to this pattern, The Trump administration’s FHFA Director, Invoice Pulte—a scion and nepo child from a rich household of homebuilders—has demanded that the central financial institution intervene to power down mortgage charges with the intention to stimulate residential dwelling gross sales and residential costs. Pulte claims that Fed chairman Jerome Powell’s lack of enthusiasm for reducing rates of interest is “the main reason” that there’s no more home-sales exercise. Pulte concludes that Powell is “hurting the mortgage market” by “improperly keeping interest rates high.” Pulte apparently believes that extra folks would purchase properties if solely the Fed mounted the scenario with decrease rates of interest.

When the Fed intervenes to decrease rates of interest, financial inflation is required. To demand decrease rate of interest coverage—as Pulte is doing—is to demand extra inflation. On the core of this inflationist place is the misunderstanding that rising dwelling costs—and their detrimental impact on homeownership—can someway be “fixed” or rendered irrelevant by decrease rates of interest. This isn’t how issues work, nonetheless. Even when mortgage charges have been to go down once more, rising costs imply owners would nonetheless be caught with increased prices and better property taxes that outcome from rising costs. Furthermore, Pulte is fallacious to even assume that Fed intervention by way of the coverage rate of interest would someway, magically, convey down 30-year mortgage charges.

Issues with Rising Dwelling Costs

Final week, we explored the numerous ways in which the Federal Reserve’s financial coverage and asset purchases have fueled rising dwelling costs. There’s a shut correlation between the central financial institution’s purchases of mortgage backed securities, the falling federal funds price, and rising dwelling costs. Falling rates of interest have fueled rising dwelling costs. This has led to historic lows within the affordability of homeownership, and a rising common age for dwelling homeowners.

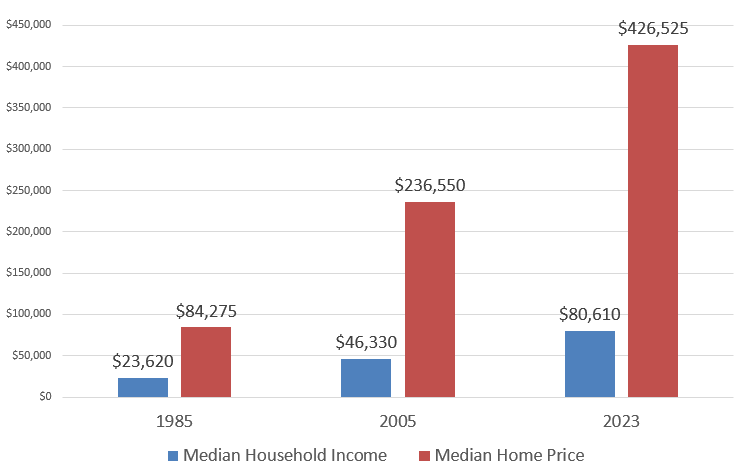

As dwelling costs have risen, properties have develop into much less inexpensive. Notably, the median dwelling worth has develop into a lot bigger over time, when in comparison with the median family earnings. In 1985, for instance, the median dwelling worth was 3.6 instances the scale of annual median family earnings. By 2023, the median dwelling worth was 5.3 instances the median family earnings.

Supply: US Census Bureau (MSPUS and MEHOINUSA646N)

Somewhat than deal with the bigger problems with asset-price inflation fueled by straightforward cash, advocates of central planning, like Pulte, insist that one of the simplest ways to “solve” the issue is to have the central financial institution someway power down mortgage charges.

Assuming that the central financial institution has the facility to do that, wouldn’t it make housing extra inexpensive? In sure methods, sure. If the one measure of affordability is the scale of the month-to-month mortgage cost, then decrease mortgage charges, all else being equal, make dwelling purchases extra inexpensive. For instance, a $500,000 mortgage at 3% for 30 years would require a month-to-month cost (on precept and curiosity) of about $2100. Then again, the identical mortgage at 6% would require a month-to-month cost of practically 3,000 monthly.

However, month-to-month prices related to a house buy don’t include solely funds on a mortgage’s principal and curiosity. Householders should additionally pay property taxes and insurance coverage. Dwelling patrons should additionally give you down funds which, in fact, are proportional to the house worth. Thus, home-price inflation results in increased down funds whereas additionally driving up property taxes—that are additionally tied to the house worth. The financial inflation that underlies rising dwelling costs additionally tends to inflate the value of providers like house owner’s insurance coverage. Principal and curiosity could also be mounted in a 30-year mortgage, however taxes and insurance coverage—which enhance with worth inflation—will not be mounted. Thus, these prices are actually not made irrelevant by falling rates of interest.

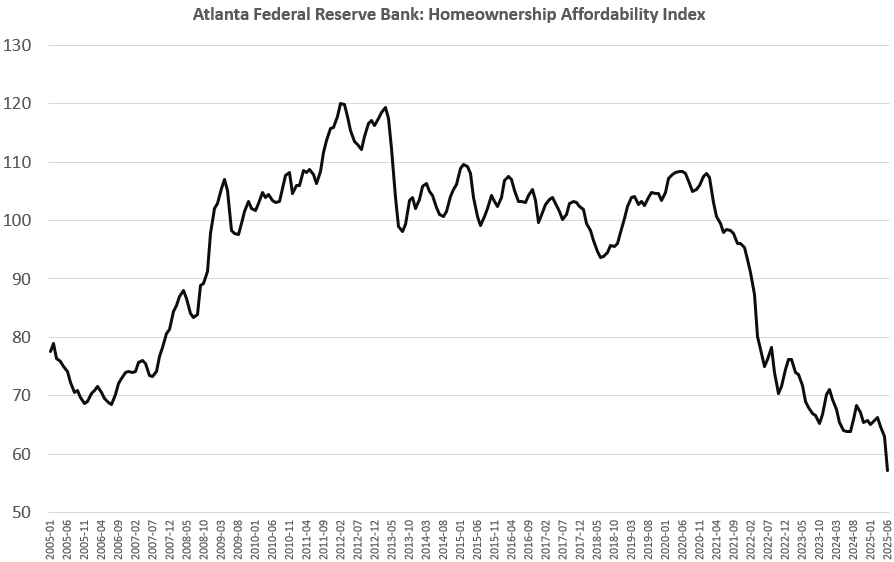

It isn’t stunning that, as dwelling costs elevated within the wake of the covid panic’s runaway financial inflation, the Atlanta Fed’s affordability index plummeted to historic lows.

Supply: Atlanta Federal Reserve Financial institution.

We are able to partly see why this occurred if we examine costs and earnings over time. In 1985, for instance, the median dwelling worth was about $81,000, however rose by 406 p.c to about $426,000 in 2023. Clearly, any taxes, insurance coverage, and down funds which can be proportional to the house worth have been far decrease in 1985 than they’re now. Furthermore, as dwelling costs quintupled from 1985 to 2023, median family earnings solely elevated by 241 p.c, rising from about $23,000 in 1985 to $84,000 in 2023.

Supply: US Census Bureau (MSPUS and MEHOINUSA646N)

These rising costs took their toll on affordability, whilst rates of interest have been falling. For instance, from 2006 by means of 2021, the typical mortgage price fell persistently. But, throughout most of that interval, the affordability index solely moved sideways.

Furthermore, this proved to be unsustainable. The issue with always falling rates of interest is that, finally, they get so low that there’s not room to maneuver downward. In 2021, mortgage charges have been at or close to all-time lows. But, the very small uptick in common mortgage charges that occurred from 2021 to 2025—with charges nonetheless beneath traditionally regular ranges—precipitated affordability to break down.

So, Pulte is solely fallacious if he’s claiming that the Fed would enhance the affordability of properties if solely Jerome Powell would intervene to power down mortgage charges.

Does the Fed Have the Energy to Cut back Mortgage Charges?

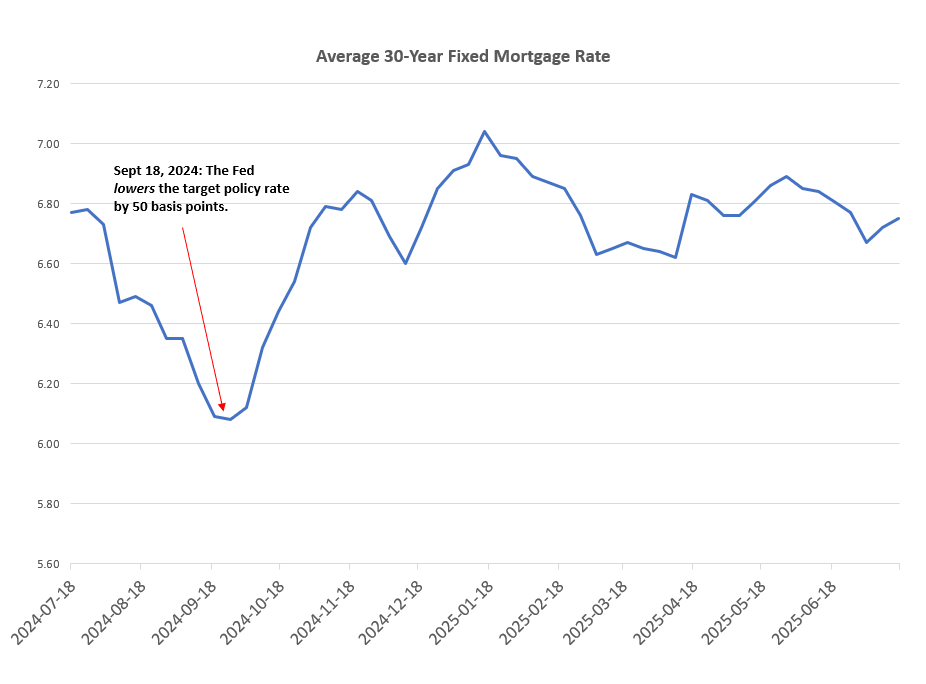

Lastly, we’ve to ask ourselves if the Fed even has the power to someway power down mortgage charges by reducing the Fed’s coverage rate of interest. It seems that this can be potential a few of the time. For instance, from 2008 to 2022—a interval when bond buyers confirmed little concern over deficits or worth inflation—each long-term and short-term yields declined because the Fed lower the goal coverage rate of interest.

These days, nonetheless, look like over. For instance, when the Fed lower the coverage price in September of final yr, the typical mortgage price elevated. Within the wake of the Federal Reserve’s excessive financial inflation of 2020-2021, and as federal deficits proceed to mount bond yields are prone to enhance if the Fed tries to embrace a brand new straightforward cash stance pushing decrease rates of interest.

Supply: Freddie Mac.

Not solely is Pulte fallacious that falling mortgage charges essentially make homeownership extra inexpensive, he’s additionally most likely fallacious that the Fed can cut back these charges by concentrating on a decrease coverage price. If Pulte actually needed to see properties develop into extra inexpensive, he would push for much less financial inflation and for decrease federal deficits. He would push for the Fed to scale back its stability sheet of mortgage backed securities. All that, nonetheless, would result in falling dwelling costs, and that might run afoul of the administration’s Wall Avenue allies who incessantly demand extra asset worth inflation.