Written By Ubaka Ogbunude

Every day, foreign nationals establish or extend their businesses into the U.S., everything from little boutiques to big enterprises.

Starting a new business in “the land of opportunities” may be a thrilling yet challenging undertaking. The complexities of establishing a business in this foreign-friendly country can be overwhelming, especially if you don’t have a sound grasp of the mechanics of United States law.

This starter guide is a helpful resource for any non-U.S. entrepreneur looking to explore the United States market. It breaks down the complexities of opening your U.S. business and covers the main regulatory and legal issues to be considered before entering the U.S. market.

Can a Non-Resident Start a Business in the U.S.?

Absolutely!

It is a common misconception that only American citizens can start a business in the U.S.

This couldn’t be further from the truth. Not only is it easy to set up, maintain and own a business in the U.S., but it is also affordable.

You’re expected to undergo the same process as American citizens when forming a business, but there are some extra hoops to jump through as a foreigner.

But as you’ll see below, they’re not particularly onerous.

Why Do Non-Residents Want to Own Businesses in the United States?

Starting a business in the United States – the world’s largest and most integrated national economy – can be one of the most exciting and rewarding experiences ever.

Here are a few reasons why many foreigners take the plunge:

- Affordable setup and maintenance – According to the World Bank, the United States ranks first in “Ease of Doing Business.” The country has earned this ranking by providing the most business-friendly regulations and low setup fees.

- Access to U.S. market and capital – As a leader in global business and investments, the country prides itself on having a highly developed market economy and a big population with high purchasing power. The United States also offers a diverse and wealthy range of venture capitalists.

- Reputation – The United States has an excellent economic reputation. Besides having the world’s largest nominal gross domestic product, the country also boasts the world’s largest nominal net wealth.

- Tax benefits – The United States tax system favors small businesses and offers various legal structures to award tax benefits while sheltering business owners from personal liability.

- Great banking system – You’ll enjoy low banking fees, a stable US Dollar currency, and deposits are insured up to $250k by the FDIC.

- Multiple payment processors – You have access to popular payment processing options like Stripe, PayPal, Shopify Payments, etc.

A Step-by-Step Guide to Doing Business in the U.S.

We created this beginner’s guide to help take the guesswork out of the process and improve your chances of success.

- Determine Your Legal Business Structure

Before you can register your business, you need to decide what kind of entity it is. Your business structure legally affects everything from your personal liability if something goes wrong to how you file your taxes.

There are many business structures, but the United States offers just two ways to structure a company for non-residents.:

- Limited Liability Company (LLC): This is a formal legal structure that separates personal assets from company debts. An LLC protects from liability during litigation. Under this business structure, you are exempted from the stringent bookkeeping regulations and are not required to pay corporate taxes.

- C Corp: This is a formal legal structure that clearly defines taxation, governance, and compliance rules. The cost of forming a C Corp is higher than that of other business structures, but it benefits from the opportunity to expand by providing unlimited shares. C Corporations are typically used by big corporations seeking to attract venture capital.

Ultimately, it is up to you to decide the type of entity that’s best for your current needs and future business goals.

PRO TIP: It’s vital to learn about the various legal business structures available to foreigners. If you’re having a hard time making up your mind, consider discussing the decision with a financial or legal advisor in both your home country and the U.S.

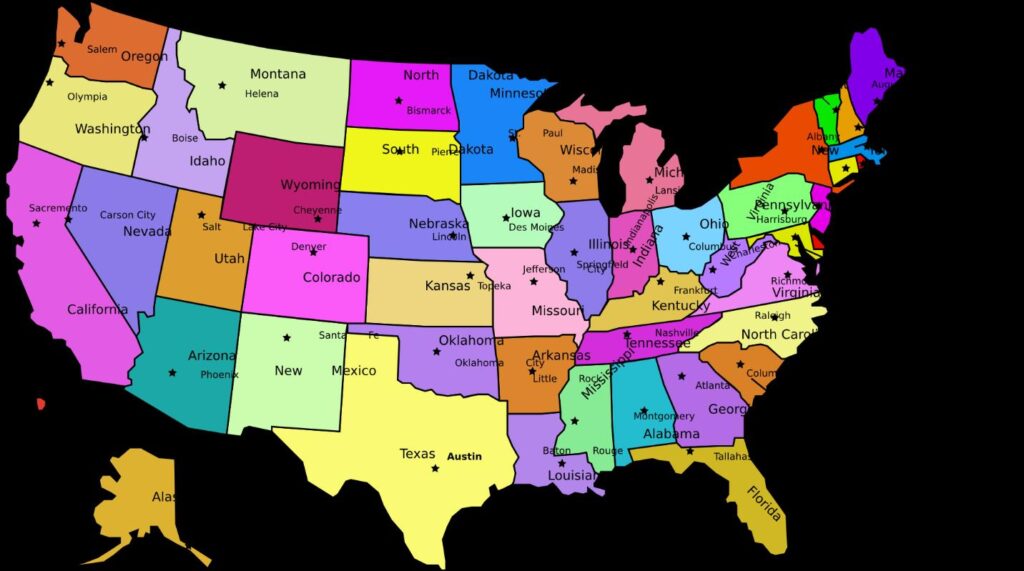

- Pick Your Business Location

Your choice of business location is one of the most important decisions you’ll make.

Whether you’re launching an online store or setting up a brick-and-mortar business, the choices you make could affect your revenue, legal requirements, and taxes.

Delaware is a favorite among foreign entrepreneurs due to its outsider-friendly rules and “flexible” corporate law that offers generous protections to directors and shareholders.

The state’s corporate law website is available in 10 languages, and you don’t need a bank account or a local physical address to start a business.

- Register Your Business and Get Licenses

The registration process varies a little from state to state and primarily depends on whether you’re forming an LLC or a corporation.

- After choosing the business structure and picking a location, you should next choose a business name. Make the name memorable but not difficult. Select the same domain name, if available, to establish your internet presence. Your business name can’t be the same as another registered business in a state, nor can it infringe on another trademark or service mark already registered with the USPTO – United States Patent and Trademark Office. If you’re operating under a name that’s different from the legal name of your business, you may need to file a doing business as (DBA) name.

- With the business name out of the way, you can apply for an Individual Taxpayer Identification Number (ITIN).

- Once you have an ITIN, you can apply for an Employer Identification Number (EIN) using Form SS-4, then obtain a physical U.S. mailing address. An EIN is required to open a U.S. bank account, pay taxes, and get a business license.

- Depending on your business type, licenses and permits that you may need to consider include a liquor license, agricultural permit, federal firearms license, FAA license, maritime transportation license, fish and wildlife permit, FCC license, and DOT permits.

- Next, file a Certificate of Incorporation or Articles of Organization. You must follow your chosen state’s procedures to formally register a business in that state.

- Finally, choose a registered agent residing in the state where you formed your business to accept all of your vital tax and legal documents.

- Open A Business Bank Account

Opening and maintaining a business bank account is essential for any business owner, whether or not they’re a U.S. resident. You need a bank account to manage your finances.

But if you want to open up a bank account in the U.S. as a foreigner, you’ll be required to provide the proper paperwork.

The Patriot Act, which came into effect after 9/11, makes it difficult for foreigners to open an American bank account.

The act requires that financial institutions verify the identity of anyone opening an account with them and that this person passes all mandatory anti-terrorism and anti-money laundering checks.

Here are some ways to satisfy this requirement:

- Visit a U.S. bank with a local branch in your country of origin, and if their policies allow such an arrangement, request ID verification.

- Get a visitor visa, travel to the United States, visit your bank of choice, and open an account.

- Use third-party services to help you set up a bank account.

Paperwork can include proof of identity, business formation documents, a legal address, and your EIN.

- Employment Considerations

When establishing a business, you may decide to hire some help.

By law, you’re only permitted to employ individuals who have permission to work in the United States. The online E-verify system allows you to determine the eligibility of potential employees.

It would be best if you also were sure to have all employees who will work with your company sign an IP assignment agreement prior to them doing any work.

Healthcare and other workplace benefits play a major role in hiring and retaining employees.

Employee benefits required by law include:

- Workers’ Compensation: Required through a self-insured basis, commercial carrier, or state Workers’ Compensation Program.

- Social Security taxes: You must pay Social Security taxes at the same rate as your employees.

- Leave benefits: Stipulated in the Family and Medical Leave Act (FMLA).

- Disability Insurance: Disability pay is required in New York, New Jersey, Hawaii, California, Rhode Island, and Puerto Rico.

- Unemployment insurance: This varies by state, and you may need to register with your state workforce agency.

- Tax Requirements

Your business must comply with local, state, and federal tax laws throughout the operation of your business in the country.

The United States has 50 states and Washington, D.C. This means there are 51 different locations with different laws and levels of local taxation.

Your business will be taxed at the same rate as United States corporations (35 percent currently) on all income connected to said business.

C Corps are subjected to two levels of tax; one at the stockholder level and another at the entity level. You should also be aware that United States corporations are taxed on their global income.

A C Corp held by a foreign business operating in the United States via a branch will be subject to a 30 percent withholding tax on select forms of non-business income accrued in the United States, along with an extra branch profits tax.

- Do I Need a Visa to Open a Business in the United States?

You can technically start and own a business in the U.S. without being a citizen or resident. Managing a corporation or LLC from outside the country is legal, but you’ll not be allowed to enter the country without a valid work visa.

The E-2 Treaty Investor visa is the most popular route among foreign entrepreneurs.

To obtain an E-2 visa, you must:

- Plan to invest or have already invested a large amount of money (at least $100k) in a U.S. firm.

- Be a citizen of a country with which the U.S. has signed a Treaty of Friendship, Commerce, or Navigation.

- Demonstrate that you own a controlling interest in your company (50 percent or more).

- Plan to return to your home country once the visa expires.

You can get an EB-5 visa by investing significant capital in the economy.

Investing $1 million in a new business enterprise while creating at least ten full-time employment positions will help you qualify for an EB-5 Immigrant Investor Program visa.

The investment requirement is lowered to $500k if you invest in a targeted area or infrastructure project.

- Devise an Exit Strategy

An exit strategy is vital for any business as it outlines how you’ll transfer ownership or sell the company if you decide to move on to other projects.

An exit strategy also lets you get the most value out of your business when it’s finally time to sell. There are a handful of options for exiting a business, and the best option for you depends on your unique goals and circumstances.

The most common exit strategies are:

- Closing the doors and walking away

- Passing the business down to family members

- Liquidating the business assets

- Selling the business to another party

Dissolving a business in the U.S. is affordable. Most states do not require a fee to dissolve a business entity.

Where Else Can I Find Help?

Whether you want to open a retail store, a restaurant, or anything else, the US Small Business Administration is a great resource for more comprehensive info on how to start a business in the US for foreigners.

If you’re still looking for a deeper dive, check out the U.S. government’s Business USA – a central governmental platform for small businesses to access information and services intended to help them get started and grow.