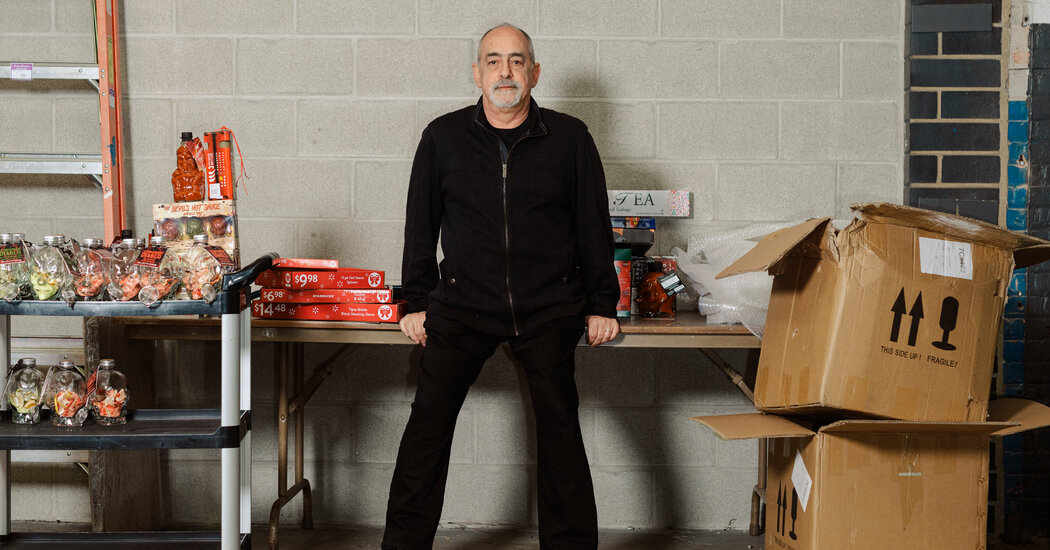

David Reich assumed that a contract was a contract.

His Chicago company, MSRF, assembles gift baskets for Walmart, Walgreens and other huge chains, importing key elements such as mugs and bowls from China. To move his goods across the Pacific, he has relied on agreements with some of the world’s largest container shipping companies.

But last year, just as Mr. Reich was preparing for the holiday season, he discovered that his contracts appeared to guarantee nothing.

On paper, Mr. Reich was guaranteed a minimum number of containers per year going from China to Chicago, at prices between $4,000 and $5,000 per journey, seemingly providing a handle on his future costs. Yet over the past year, HMM, a South Korean shipping giant, has moved only nine of his promised 25 containers, while Yang Ming Marine Transport, a Taiwanese firm, has transported only four of 100 loads, according to Mr. Reich and documents examined by The New York Times.

The carriers refused to confirm bookings even when his company assented to special premium charges, Mr. Reich said. Facing calamity, he has been forced to pay prevailing market rates, spending an average of $15,000 per container.

“We are finding it impossible to get containers right now,” Mr. Reich said. “It is just brutal.”

His frustrations are part of a chorus of grievance directed at the 10 companies that dominate international shipping, all of them based outside the United States. In a global economy long dependent on cheap ocean cargo, the chaos roiling the seas has provoked accusations of monopolistic practices by the shipping giants, prompting businesses to prepare complaints they plan to file at the Federal Maritime Commission, which regulates the industry. It has also triggered legislation in Congress aimed at beefing up the commission’s authority to challenge abuses by shipping firms.

“It’s just them manipulating the market to see how high they can drive the price,” said Jason Delves, chief executive of F9 Brands, a Tennessee company that imports flooring, cabinetry and outdoor furniture, predominantly from Asia. “Contracts are not worth the paper they are written on these days. They just don’t honor them.”

The five largest container-shipping companies collectively made profits of more than $64 billion last year — an increase of $41 billion from the previous year — according to a report compiled by Accountable.US, a watchdog organization.

This year, container shipping carriers are on track to log some $300 billion in profits before taxes and interest, according to a recent estimate from Drewry, a maritime industry research and consulting firm.

Yang Ming did not respond to questions for this article. After publication, a representative for HMM, Hyungjoon Kim, said in a statement that the carrier had not violated its contract with Mr. Reich’s company and was “supporting all its customers to the best of its ability under the current market conditions.”

The shipping industry maintains that higher prices and profits reflect shifts in supply and demand combined with impediments to the smooth flow of goods through the broader supply chain, from warehouses overwhelmed by goods to trucking fleets struggling to hire enough drivers.

“When you say, ‘What’s fair?,’ you have to ask a fundamental question,” said John Butler, president of the World Shipping Council, an industry association in Washington. “Do you trust the market, or do you only trust the market when it’s a buyer’s market?”

But American importers — especially small and medium-size businesses assailed by disruptions to trade brought by the coronavirus pandemic — accuse the carriers of refusing to honor their contracts, denying them space on vessels and prioritizing shipments for larger and more lucrative customers like Amazon and Walmart.

Understand the Supply Chain Crisis

Mr. Delves’s business has contracts securing rights to move 1,040 containers a year full of cabinets and home furnishings from China, Vietnam, Malaysia and Indonesia to U.S. ports, at an average cost of $6,970 per shipment, he said. But over the last year, carriers have delivered only 166 containers at the contracted rate.

Desperate to secure inventory, Mr. Delves has resorted to effectively bidding for containers, spending an average of about $15,000 per container on 355 shipments, while shelling out for “premium service” on another 163 loads at an average of $22,500 each.

“The only thing that premium and superpremium guarantee you is that you are paying more for that container,” Mr. Delves said. “It’s not guaranteeing that you’re going to get a container, or it’s going to get on the ship.”

Frequently, carriers have refused to confirm bookings on specific container vessels, citing a lack of space, he said, even as his own queries to third-party shipping agents yield offers of passage on the same ships, at rates three or four times those in his contracts.

“If we were doing what they are doing, we’d get arrested,” Mr. Delves said.

Surging shipping costs have intensified inflation around the world, according to recent research from the International Monetary Fund. The increase in shipping rates last year will lift the price of goods by an estimated 1.5 percent worldwide this year. And the war in Ukraine has since worsened disruptions, almost certainly compounding and extending the impact on consumer prices, the I.M.F. researchers noted in a recent blog post.

President Biden used his State of the Union address to accuse the shipping industry of exploiting disruption to drastically raise prices. He unleashed a joint task force staffed by the Justice Department and the Federal Maritime Commission to investigate alleged market abuses by the carriers.

In an interview, the chairman of the commission, Daniel B. Maffei, vowed that his agency would “vigorously investigate any specific claims against an ocean container carrier.” But he noted that contract disputes must generally be adjudicated in court. And he added that, frequently, claims of unfair treatment from importers turned out to violate only “the spirit of the contract without violating the letter of the contract.”

Mr. Reich’s contract with Yang Ming includes a provision that appears to give the carrier latitude. The shipping company is obligated to furnish the minimum number of containers, while “taking into account any adverse impact due to market or industry conditions not foreseen or controlled by carrier.”

For decades, importers had little reason to scrutinize the fine print of their agreements with their carriers, because space on ships was cheap and abundant. The crisis facing the importers now is the product of a previously unknown state of affairs — not enough ships to manage extraordinary demand in the face of market turmoil delivered by the pandemic.

Some experts maintain that the current state of play is the predictable result of the deregulation of the shipping industry that began in the 1980s under the Reagan administration.

In passing the Shipping Act of 1984, Congress lifted antitrust strictures that had limited the power of shipping companies. The law gave the carriers the right to forge alliances and coordinate their prices.

How the Supply Chain Crisis Unfolded

The pandemic sparked the problem. The highly intricate and interconnected global supply chain is in upheaval. Much of the crisis can be traced to the outbreak of Covid-19, which triggered an economic slowdown, mass layoffs and a halt to production. Here’s what happened next:

So began a wave of consolidation. Today, the 10 largest carriers are organized into three major alliances not unlike those that prevail in the airline industry, with members sharing routes and bookings.

Yet even under the changes of 1984, cargo prices had to be disclosed publicly and made available on equal terms to all shippers. That changed in 1998, during the Clinton administration, as Congress gave the carriers the right to negotiate contracts with customers in private, at undisclosed terms.

“The bill’s provisions allowing completely secret contracts go too far, and risk discrimination and abuse adverse to U.S. trade interests,” warned the Federal Maritime Commission’s chairman at the time, Harold J. Creel Jr., during a congressional hearing in 1997.

But such dangers did not materialize for decades, because of a glut of container space. State-owned conglomerates in Asia subsidized the construction of shipping fleets as a means of boosting their national exports, making vessels plentiful.

That propelled the advance of globalization, allowing mammoth-scale retailers like Walmart, Amazon and Home Depot to scour the world for lower-cost factory goods.

It also placed the largest shipping companies in a position of extraordinary dominance.

Between 2011 and 2018, the three shipping alliances expanded their share of the container market to about 80 percent from 29 percent, according to a report from the International Transport Forum, an intergovernmental body based in Paris. On trans-Pacific routes, the three alliances controlled 95 percent of the market.

“We legalized secret rebates and monopolization in shipping, which led to consolidation, bankruptcies, and now price gouging and huge backlogs that favor big retailers and ocean carriers over everyone else,” said Matt Stoller, director of research at the American Economic Liberties Project, an antimonopoly research and advocacy organization in Washington.

The pandemic was the shock that revealed the folly of this course, he added.

As Covid-19 emerged in China in early 2020 and then spread around the world, carriers cut capacity — mothballing ships and canceling routes — on the assumption that the world was headed into a severe economic downturn that would limit demand for a vast range of products.

But the pandemic did not limit demand so much as change its composition. Deprived of access to offices and gyms during months of lockdown, Americans spent aggressively on office furniture for their bedrooms and exercise equipment for their basements.

The result was a tremendous surge in demand for shipping containers carrying goods from factories in Asia to consumers in the United States, prompting floating traffic jams off American ports, from Southern California to Savannah, Ga.

The largest American importers, including Amazon and Walmart, have chartered their own vessels to navigate the turmoil. But smaller companies have found themselves at the mercy of carriers that can be choosy about whose cargo they will carry.

In Chicago, Mr. Reich’s contracts were set to expire at the end of April. Yang Ming and HMM have refused to even negotiate renewals, he complained.

“They said, ‘Sorry, we’re too busy,’” Mr. Reich said. “They have taken care of the big customers, and there is no room at the inn.”