The interview started off and flowed as follows;

Q1. As a professional VC, how did you consider entering this sector?

Alex: There is a personal story behind this, a couple of years ago I was looking for information with regards to treating epilepsy for my son with CBD as I noticed that a lot of parents were using it successfully for their children in North America. Being a Canadian myself, I was well aware of what was going on in the cannabis industry there. This is when I reached out to John who is an American Neurologist in Paris whom I knew very well, he is now a co-founder and our Chief Medical Officer.

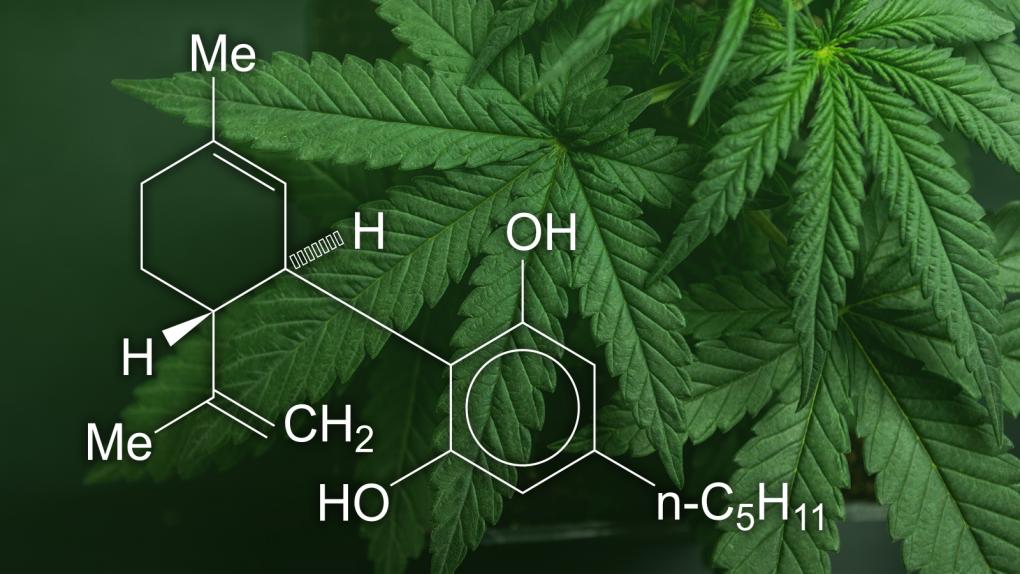

John: When Alex asked me about CBD for epilepsy, it was unknown territory for me scientifically speaking. Then, I did my research and discovered the potential of the endocannabinoid system. This system is found in man and all vertebrate species, it is used as the body’s way to create homeostasis and adapt to environmental stress and changes. Modulation of this widely distributed regulatory system appears to have therapeutic (medical) value depending on the disease entity and severity. Endocannabinoid receptors are located in areas of the brain, especially those concerned with cognition, movement, coordination, pain, sensory perception, emotion, memory, autonomic and endocrine but are also found in the gastrointestinal tract. I also discovered that there was a recent surge in publications and IP filing in the sector that showed signs that it is evolving into a more IP-rich domain with a strong focus on innovative therapeutics targeting the endocannabinoid system.

Alex: As a VC investor, I realized that beyond “medical cannabis”, the real opportunity is in exploiting the endocannabinoid system: targeting unmet needs, new indications, rare diseases, and alternatives to current therapies in markets that exist today but are ripe for disruption. That is how we identified that an opportunity existed for a dedicated VC fund. Today, Oskare fund is the only AIFMD regulated fund in Europe that addresses the financing needs of start-ups operating in this field.

Q2. What are the types of portfolio companies you are targeting?

Alex: ÓSKARE Fund has a unique positioning that will focus on investments aimed at creating outcomes and solutions to unmet needs and unrealized opportunities within the healthcare and the medical cannabis sector. We will look to invest in companies developing new molecules and a combination of products for specific medical conditions in humans and animals, as well as the needed technologies and infrastructure related to realizing the opportunities presented by cannabinoids.

This pick and shovel strategy will focus on companies bringing solutions to pain points across the value chain. We are not investing in production or recreational cannabis.

Our first investment is Herbolea which is an Italian biotech company that licenses a patent-protected extraction system to processors of cannabis, hops, and other commercial harvests for applications in the food and fragrance industry. The system is expected to become the new market standard replacing CO2 and solvent-based extractions over the next 3-5 years. Our second investment is Octarine Bio, a Danish company that is developing a unique biosynthetic platform, molecule design, and enzymatic reactions, to engineer microorganisms to produce a range of natural and novel cannabinoids and psilocybin-derived molecules with improved pharmacokinetic and therapeutic properties.

We are also considering investing soon in a UK digital pain clinic aiming to be an alternative in the treatment of chronic pain symptoms by combining mind, movement, and medication. The platform prescribes a variety of pain medications, including medical cannabis.

Q3. In North America, private investors have been fueling the sector for some years now. What is the peculiarity of the European market and is there a specific profile of investors in the Oskare fund?

Gaetano: The American market has been mainly driven by recreational cannabis, investors focusing on Multi-State Operators, and brands. With medical cannabis in the US being federally illegal, R&D has been hindered although it is starting to catch up. In most EU countries medical cannabis is federally legal enabling public R&D to operate legally and obtain funding and perform research. As such, there has been a surge in spin-offs and company creations since 2017. Current research is being led by EU-based teams who are providing the IP to produce the global therapeutic champions of today and tomorrow. In addition, State-run healthcare systems will pave the way for the adoption of Medical Cannabis.

Our investors are mainly family offices who not only see the opportunity of a fast-growing market but also consider the social benefit of new therapeutics on patients’ life and wellness. Our investment thesis has also attracted a pharma company.

Q4. What have been some of the greatest challenges or arguments you had to face during your fundraising?

[Laugh]…

Alex: The first was the COVID-19 pandemic as the difficulty to travel and meet investors has led investors to put capital commitments with new managers on hold. But this is true for all Private Equity fund-raising.

The second is the stigma around cannabis coming from the lack of knowledge of investors in medical cannabis regulation and/or research. We spend a lot of time educating and informing investors on what is going on in the market. Think about an untapped $5b market expected to grow 3x in the next 5 years. We position ourselves as a hybrid Deeptech and Life Sciences fund targeting a new therapeutic sector.

For more information visit www.oskarecapital.com

You may also like

-

New rule proposed by HHS aims to reduce racial disparities among Black kidney transplant patients

-

Revolutionizing Sustainable Technology: Breakthrough Nanogenerator Poised to Transform Renewable Energy, Healthcare Monitoring, and Consumer Electronics

-

Breaking Barriers: Yuval Kanev’s ‘Helpless Earth: Reckless Science’ Provokes Urgent Dialogues on Technological Accountability

-

Workers in Atlantic City casino smoking lawsuit decry 'poisonous' workplace; state stresses taxes

-

A rural Ugandan community is a hot spot for sickle cell disease. But one patient gives hope