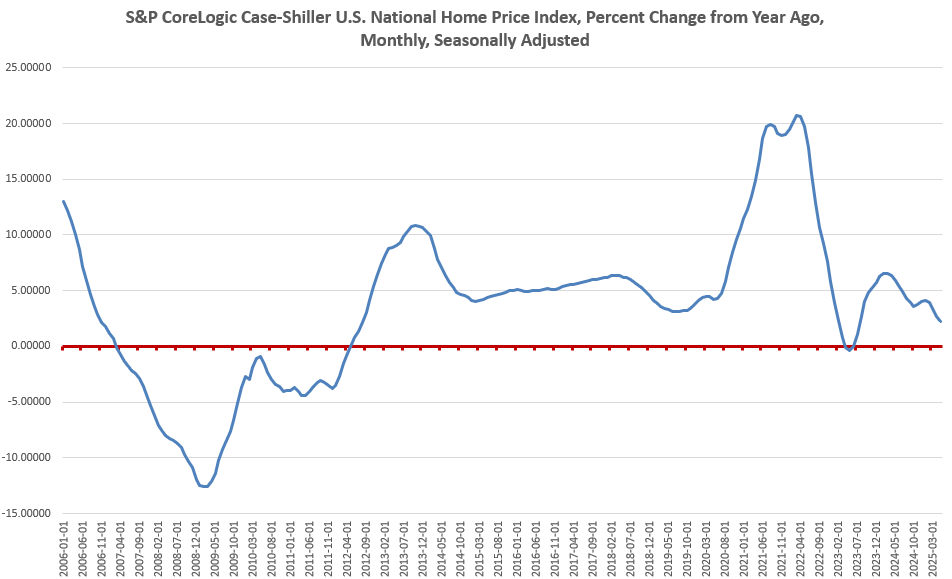

In response to the most recent Case-Shiller house value report, launched on Wednesday, house costs fell for the third month in a row throughout Might 2025, the newest month, for which information is out there.

The Might report finds that the U.S. Nationwide home-price index fell 0.29 % from April to Might. That’s the third month in a row throughout which the index fell. The falling index displays weakening demand for properties in a variety of the cities, surveyed with twelve cities exhibiting outright declines. These cities embrace Atlanta, Dallas, Denver, Las Vegas, Los Angeles, Miami, Phoenix, San Diego, San Francisco, Seattle, Tampa, and Washington, DC. Solely 4 cities – Cleveland, Minneapolis, Charlotte, and Tampa – confirmed month-over month acceleration. (See right here for the total report.)

In contrast 12 months over 12 months, the U.S. Nationwide home-price rose 2.2 % from Might 2024 to Might 2025, slowing for the fifth month in a row. Might’s home-price development was additionally the bottom since 2023 within the aftermath of the asset-price inflation fueled by covid-era stimulus. Excluding the covid interval, Might’s house value development got here in on the lowest since August of 2012.

As with month-to-month traits, decelerating home-price development was fueled particularly by a variety of cities within the Western and Solar Belt areas. The 5 cities with the weakest development charges, 12 months over 12 months, have been Los Angeles (-0.48%), Miami (-0.12%), San Francisco, (-0.02%) and Seattle (0.03%), and Phoenix (0.06%).

In response to the Case-Shiller press launch:

“May’s data continued the year’s slow unwind of price momentum, with annual gains narrowing for a fourth consecutive month,” stated Nicholas Godec, CFA, CAIA, CIPM, Head of Fastened Revenue Tradables & Commodities at S&P Dow Jones Indices. “Nationwide house costs have been simply 2.3% greater than a 12 months in the past, the smallest improve since July 2023, and practically all of that acquire occurred in the newest six months. The spring market lifted costs modestly, however not sufficient to counsel sustained acceleration. …

“Month-to-month traits additionally signaled broad-based fatigue. All three headline indices rose simply 0.4% on a non seasonally adjusted foundation, the slowest month-to-month acquire since January. … Solely 4 cities – Cleveland, Minneapolis, Charlotte, and Tampa – confirmed month-over month acceleration, pointing to waning momentum breadth at the same time as most cities nonetheless registered nominal good points.

Rising stock in lots of cities-especially in Western and Solar Belt cities, continues to level towards slowdowns and declines in house value development. Anecdotal proof about for-sale stock continues to counsel this pattern will proceed. For instance, in line with Realtor.com, lively listings skilled a “enormous leap“ in June. 12 months-over-year lively listings have been up by 77.6 % in Las Vegas, 63.6 % in Washington, DC, and 56.4 % in Raleigh, NC.

Numerous elements are at work right here. One issue is that the typical 30-year fastened mortgage price has greater than doubled since 2022, rising from 2.9 % in July of 2021 to six.7 throughout July of this 12 months. This alteration has made month-to-month mortgage funds unaffordable to a rising portion of the market. For instance, a $500,000 mortgage requires a month-to-month cost of $2,100 monthly whereas the identical mortgage at 6.5 % requires a cost of $3,160 monthly.

This has prompted many potential patrons to suppose twice about shopping for, and stock has consequently been rising. This pattern towards hesitancy in shopping for has additionally been because of the stagnation in each the job market and in manufacturing total. Furthermore, debt in areas aside from mortgages has been surging, as has delinquencies on these money owed.

In the long run, although, sellers must decrease their asking costs in the event that they need to promote their properties in a market with a lot greater mortgage charges. That might be good for potential house patrons. House costs have solely very lately begun to regulate, nonetheless, as we see within the Case-Shiller information. In some main metros, costs are nonetheless heading up.

Given how a lot the US regulatory state and the central financial institution intervene to prop up house costs, although, it’s outstanding that house costs have fallen in any respect. It is very important needless to say the US federal authorities routinely intervenes within the mortgage markets to drive up each demand and costs. (Excessive asset costs are good for Wall Avenue particular pursuits.)

For instance, the de facto federal companies of Fannie Mae and Freddie Mac exist to extend liquidity in mortgage markets, driving up costs. Furthermore, the Federal Reserve has, since 2008, purchased up greater than $2 trillion in mortgage backed securities, additionally stimulating further funding in for-purchase housing, and better costs. Have been the Fed to dump these belongings, mortgage charges would additional rise and costs would fall way more quickly than we at the moment are seeing.

Due to these incessant efforts to boost asset costs, house costs proceed to be comparatively resilient. Costs don’t replicate actual market provide and demand, after all, however they do, nonetheless, replicate the manufactured actuality of government-stimulated asset pricing.

It’s doubtless we are going to solely see substantial declines in house costs because the job market continues to worsen. This will come about in two methods. Job losses might mount in the identical method as we frequently see in recession: individuals lose their jobs, after which they grow to be motivated sellers, fueling foreclosures and falling house costs. One other risk is that value inflation in areas aside from for-purchase housing will proceed to construct and owners are pressured to downsize as wages can not sustain with the price of dwelling.

In spite of everything, the newest information on value inflation continues to point out that costs are transferring upward, and never again to the Fed’s two-percent price-inflation purpose. Right this moment, for instance, new information from the BLS exhibits that PCE inflation rose 2.6 % in June, 12 months over 12 months. That’s up from Might’s annual improve of two.4 %. Items costs, in the meantime, posted their largest acquire since January.

Sadly, our ruling oligarchy, for greater than thirty years, has determined that it prefers rising asset costs—which favor Wall Avenue cronies and others who already personal belongings—over affordability for unusual individuals. That is what central financial institution coverage and federal regulatory coverage is geared towards: to make sure ever rising asset costs, even when it means middle-class wages can not sustain.

That is additionally why we proceed to listen to more and more frantic calls for from the Trump White Home demanding that the central financial institution decrease rates of interest. Sadly for Trump and different associates of rich asset homeowners, it’s not clear that the central financial institution can, at this level within the cycle, convey mortgage charges down considerably. The final time the Fed pressured down rates of interest, the typical mortgage price really elevated. As long as ongoing worries about inflation and federal debt persist amongst bond buyers, long run yields might stay stubbornly excessive.