A record-setting spike in coronavirus cases kept millions of workers at home in January and disrupted businesses from coast to coast. But it couldn’t knock the U.S. job-market recovery off course.

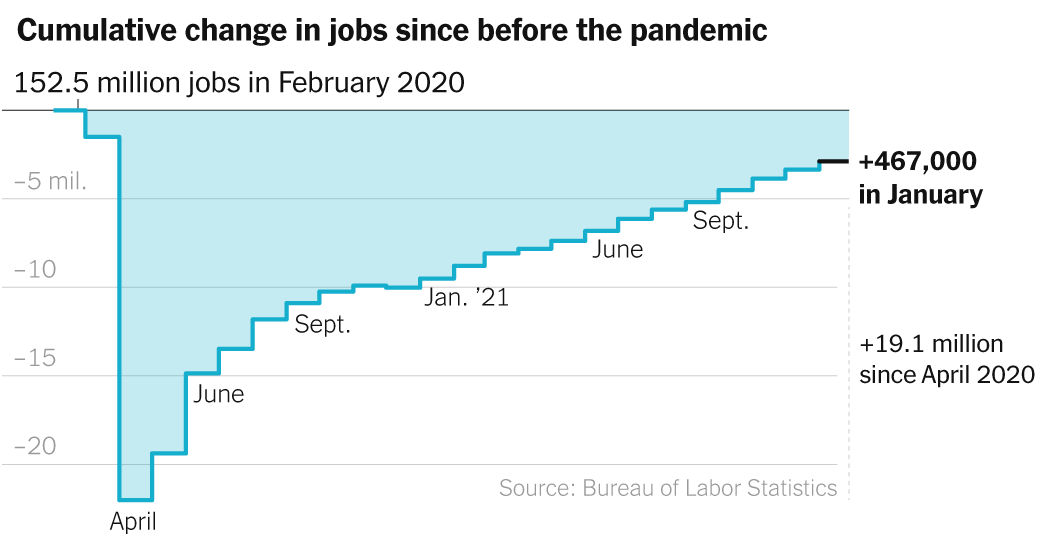

Employers added 467,000 jobs in January, seasonally adjusted, the Labor Department said on Friday. The report smashed the projections of economists, who had been expecting the wave of coronavirus cases associated with the Omicron variant to lead to anemic gains, if not an outright decline in jobs. Instead, employers kept on hiring.

“Clearly something is different about this surge,” said Julia Pollak, chief economist for the career site ZipRecruiter. Companies that struggled all fall to recruit workers weren’t about to reverse course just because cases shot up for a few weeks, she said. Even restaurants and hotels, which slashed jobs during earlier pandemic waves, hired workers last month.

“Employers who have been engaged in this dogfight for talent, they’re not standing down,” Ms. Pollak said. “They are sticking around because they think the surge will be over soon.”

At the White House on Friday, President Biden hailed the economy’s “historic” progress. “America’s job machine is going stronger than ever,” he said.

The January data was collected in the first weeks of the year, when coronavirus cases topped 800,000 a day and millions of workers were kept home by positive tests, suspected exposures or child care disruptions. More than 3.6 million people reported being absent from work because of illness, more than at any prior point in the pandemic. Remote work, which had been trending down as white-collar employees returned to the office, jumped back up in January.

Omicron did take an economic toll. The unemployment rate rose slightly to 4 percent as some businesses laid off or furloughed employees. An alternative measure of employment, based on a survey of households, actually fell by more than a quarter-million. And economists warned that measurement issues and other quirks made the data difficult to interpret.

Still, the overarching message of the report was one of resilience in the face of a resurgent pandemic. Revised estimates showed stronger job growth in November and December than reported earlier, indicating that the economy lost less momentum at the end of the year than previously believed. And the solid gain in January suggests that Omicron, while disruptive, did little to dent employers’ underlying confidence in the recovery.

“We saw a two-week timeout in the country,” said Becky Frankiewicz, president of ManpowerGroup, a staffing firm. At the peak of the recent wave, she said, nearly a third of Manpower’s in-person workers in several cities were absent. Now, she said, “we’re starting to see people come back out of it.”

Officials at the White House, who had spent days preparing reporters and the public for the possibility of a grim report, were openly relieved on Friday.

“I don’t think I’ve ever been happier to be more wrong,” Jared Bernstein, a top economic adviser to Mr. Biden, wrote in an email.

The U.S. economy has regained more than 19 million of the 22 million jobs lost in the early weeks of the pandemic, and the unemployment rate has fallen far faster than forecasters expected, even after the uptick in January.

Yet Mr. Biden has struggled to convince voters that his economic policies are working, in part because of lingering supply-chain bottlenecks, labor shortages and the highest inflation in decades.

The January data provided little indication that those issues will be resolved quickly. The number of adults participating in the labor force fell last month, suggesting Omicron may have added to hiring difficulties. And average hourly earnings continued to rise — good news for workers, but a possible source of concern for policymakers at the Federal Reserve, who have become increasingly worried that wage gains may become a larger driver of inflation.

Adrian Washington, a residential developer in the Washington, D.C., area, said Omicron had done little to set back his business, in part because the wave hit Washington over the holidays, when activity tends to slow anyway. He posted several open positions in January, and plans to do more hiring this year.

“Really, I am — and I think other people are — starting to look past Omicron and saying, ‘OK, we’ve shifted from fighting it to living with Covid,’” he said.

But the ripple effects of the pandemic are still affecting Mr. Washington’s business. He offered raises of 10 to 15 percent at the start of the year in a bid to retain employees in an increasingly competitive job market. And snarled supply chains force him to order lumber and other key materials months earlier than normal, and at higher prices. That means taking risky bets when rising interest rates make the outlook for the housing market uncertain.

“We’re accepting these cost increases now with the hope we can pass them on, but who knows?” he said.

While Omicron appears to have done less damage to the overall economy than many people feared, it has been painful for many individual families and businesses. Six million people reported in mid-January that they had worked fewer hours — or not at all — at some point in the previous four weeks because their employer closed or lost business as a result of the pandemic, the Labor Department said. That was about twice the number who reported such a disruption a month earlier.

Robert LeBlanc, a restaurateur in New Orleans, had six locations heading into the pandemic — a mix of local restaurants and neighborhood bars, as well as a small hotel — “all of which were profitable, soundly profitable,” he said. But the economic ravages of Covid-19 led him to shut half of his businesses even before the latest wave.

“Half our man-hours were lost because of Omicron,” he said. “We had to close down each one of our restaurants for at least two days — some of them for four or five days — because we had so many people who had it at once, and now subsequently pretty much everybody on our team has gotten it and had to quarantine and take time off.”

Sales have sunk to levels not seen since the darkest days of 2020.

This “last blow of Omicron” felt like “the worst one yet,” Mr. LeBlanc said. Not only did lunch and dinner crowds seem to thin out, but the government aid that helped get the business through past surges was no longer available. “People in the industry are just running out of gas,” he said.

Workers, too, have had to face this stage of the pandemic without the expanded unemployment benefits and other aid that the government offered earlier. That has drawn criticism from some progressives, who argue that the Biden administration is effectively declaring victory too soon. The unemployment rate for Black workers was 6.9 percent in January, more than double the rate for whites. Other groups, such as Hispanic workers and people without a college degree, are also still experiencing elevated levels of unemployment.

“I still see the administration celebrating the greatest recovery and quickest recovery in our history,” said Alex Camardelle, director of work force policy at the Joint Center for Political and Economic Studies, a research group focused on issues facing Black Americans. “We’re saying, ‘Not so fast.’”

Jose Ramirez, a fast-food worker in San Francisco, woke up on New Year’s Eve with a tickle in his throat. Within days, he was running a fever and had tested positive for Covid-19. His three children and his 78-year-old father, who lives with them, also contracted the virus.

Mr. Ramirez, 33, said his first concern was for his children, two of whom are too young to be vaccinated, and his father, whose age puts him at greater risk. But the financial impact was never far from his mind.

Mr. Ramirez, who is from El Salvador, ended up missing two weeks of work, and without paid sick leave, he earned just $250 in January. He has fallen behind on rent.

“I don’t really know what I’m going to do to pay what I owe,” he said through an interpreter. “It’s by a miracle of God that my family and I have been able to survive. But this has been very hard for me economically.”