The 67 million Individuals eligible for Medicare make an vital determination each October: Ought to they make adjustments of their Medicare medical health insurance plans for the subsequent calendar yr?

The choice is difficult. Medicare has an unlimited number of protection choices, with giant and ranging implications for folks’s well being and funds, each as beneficiaries and taxpayers. And the choice is consequential – some selections lock beneficiaries out of conventional Medicare.

Beneficiaries select an insurance coverage plan after they flip 65 or grow to be eligible based mostly on qualifying persistent situations or disabilities. After the preliminary sign-up, most beneficiaries could make adjustments solely through the open enrollment interval every fall.

The 2024 open enrollment interval, which runs from Oct. 15 to Dec. 7, marks a possibility to reassess choices. Given the difficult nature of Medicare and the shortage of unbiased advisers, nonetheless, discovering dependable data and understanding the choices accessible could be difficult.

We’re well being care coverage consultants who research Medicare, and even we discover it difficult. Certainly one of us not too long ago helped a relative enroll in Medicare for the primary time. She’s wholesome, has entry to medical health insurance by her employer and doesn’t usually take pharmaceuticals. Even on this easy state of affairs, the variety of selections had been overwhelming.

The stakes of those selections are even increased for folks managing a number of persistent situations. There may be assist accessible for beneficiaries, however we’ve discovered that there’s appreciable room for enchancment – particularly in making assist accessible for everybody who wants it.

The selection is complicated, particularly when you’re signing up for the primary time and in case you are eligible for each Medicare and Medicaid. Insurers typically have interaction in aggressive and generally misleading promoting and outreach by brokers and brokers. Select unbiased sources to information you thru the method, like www.shiphelp.org. Be certain that to start out earlier than your sixty fifth birthday for preliminary sign-up, look out for yearly plan adjustments, and begin properly earlier than the Dec. 7 deadline for any plan adjustments.

2 paths with many selections

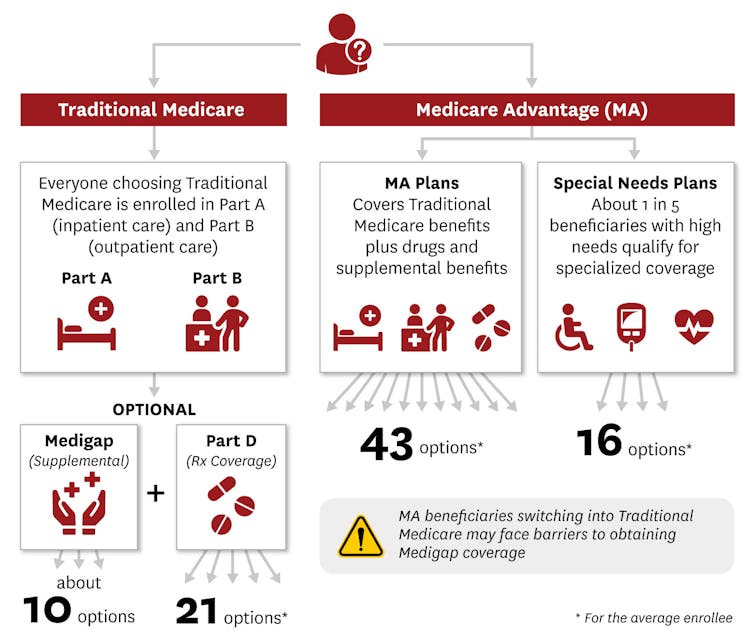

Inside Medicare, beneficiaries have a selection between two very totally different packages. They’ll enroll in both conventional Medicare, which is run by the federal government, or one of many Medicare Benefit plans provided by non-public insurance coverage corporations.

Inside every program are dozens of additional selections.

Conventional Medicare is a nationally uniform cost-sharing plan for medical companies that enables folks to decide on their suppliers for many kinds of medical care, often with out prior authorization. Deductibles for 2024 are US$1,632 for hospital prices and $240 for outpatient and medical prices. Sufferers additionally must chip in beginning on Day 61 for a hospital keep and Day 21 for a talented nursing facility keep. This share is called coinsurance. After the yearly deductible, Medicare pays 80% of outpatient and medical prices, leaving the particular person with a 20% copayment. Conventional Medicare’s fundamental plan, generally known as Half A and Half B, additionally has no out-of-pocket most.

Conventional Medicare begins with Medicare components A and B.

Invoice Oxford/iStock by way of Getty Photographs

Individuals enrolled in conventional Medicare may also buy supplemental protection from a personal insurance coverage firm, generally known as Half D, for medicine. And so they can buy supplemental protection, generally known as Medigap, to decrease or eradicate their deductibles, coinsurance and copayments, cap prices for Elements A and B, and add an emergency overseas journey profit.

Half D plans cowl prescription drug prices for about $0 to $100 a month. Individuals with decrease incomes could get further monetary assist by signing up for the Medicare program Half D Further Assist or state-sponsored pharmaceutical help packages.

There are 10 standardized Medigap plans, often known as Medicare complement plans. Relying on the plan, and the particular person’s gender, location and smoking standing, Medigap sometimes prices from about $30 to $400 a month when a beneficiary first enrolls in Medicare.

The Medicare Benefit program permits non-public insurers to bundle every part collectively and gives many enrollment choices. In contrast with conventional Medicare, Medicare Benefit plans sometimes provide decrease out-of-pocket prices. They typically bundle supplemental protection for listening to, imaginative and prescient and dental, which isn’t a part of conventional Medicare.

However Medicare Benefit plans additionally restrict supplier networks, which means that people who find themselves enrolled in them can see solely sure suppliers with out paying further. Compared to conventional Medicare, Medicare Benefit enrollees on common go to lower-quality hospitals, nursing amenities, and residential well being companies however see higher-quality main care medical doctors.

Medicare Benefit plans additionally typically require prior authorization – typically for vital companies corresponding to stays at expert nursing amenities, house well being companies and dialysis.

Alternative overload

Understanding the tradeoffs between premiums, well being care entry and out-of-pocket well being care prices could be overwhelming.

Turning 65 begins the method of taking considered one of two main paths, which every have a thicket of well being care selections.

Rika Kanaoka/USC Schaeffer Middle for Well being Coverage & Economics

Although choices fluctuate by county, the standard Medicare beneficiary can select between as many as 10 Medigap plans and 21 standalone Half D plans, or a median of 43 Medicare Benefit plans. People who find themselves eligible for each Medicare and Medicaid, or have sure persistent situations, or are in a long-term care facility have extra kinds of Medicare Benefit plans generally known as Particular Wants Plans to decide on amongst.

Medicare Benefit plans can fluctuate when it comes to networks, advantages and use of prior authorization.

Totally different Medicare Benefit plans have various and enormous impacts on enrollee well being, together with dramatic variations in mortality charges. Researchers discovered a 16% distinction per yr between the perfect and worst Medicare Benefit plans, which means that for each 100 folks within the worst plans who die inside a yr, they might anticipate solely 84 folks to die inside that yr if all had been enrolled in the perfect plans as an alternative. In addition they discovered plans that price extra had decrease mortality charges, however plans that had increased federal high quality rankings – generally known as “star ratings” – didn’t essentially have decrease mortality charges.

The standard of various Medicare Benefit plans, nonetheless, could be troublesome for potential enrollees to evaluate. The federal plan finder web site lists accessible plans and publishes a top quality ranking of 1 to 5 stars for every plan. However in observe, these star rankings don’t essentially correspond to raised enrollee experiences or significant variations in high quality.

On-line supplier networks may also include errors or embrace suppliers who’re now not seeing new sufferers, making it exhausting for folks to decide on plans that give them entry to the suppliers they like.

Whereas many Medicare Benefit plans boast about their supplemental advantages , corresponding to imaginative and prescient and dental protection, it’s typically obscure how beneficiant this supplemental protection is. As an example, whereas most Medicare Benefit plans provide supplemental dental advantages, cost-sharing and protection can fluctuate. Some plans don’t cowl companies corresponding to extractions and endodontics, which incorporates root canals. Most plans that cowl these extra in depth dental companies require some mixture of coinsurance, copayments and annual limits.

Even when data is totally accessible, errors are probably.

Half D beneficiaries typically fail to precisely consider premiums and anticipated out-of-pocket prices when making their enrollment selections. Previous work means that many beneficiaries have problem processing the proliferation of choices. An individual’s relationship with well being care suppliers, monetary state of affairs and preferences are key concerns. The implications of enrolling in a single plan or one other could be troublesome to find out.

The lure: Locked out

At 65, when most beneficiaries first enroll in Medicare, federal rules assure that anybody can get Medigap protection. Throughout this preliminary sign-up, beneficiaries can’t be charged a better premium based mostly on their well being.

Older Individuals who enroll in a Medicare Benefit plan however then need to swap again to conventional Medicare after greater than a yr has handed lose that assure. This may successfully lock them out of enrolling in supplemental Medigap insurance coverage, making the preliminary determination a one-way avenue.

For the preliminary sign-up, Medigap plans are “guaranteed issue,” which means the plan should cowl preexisting well being situations with out a ready interval and should enable anybody to enroll, no matter well being. In addition they should be “community rated,” which means that the price of a plan can’t rise due to age or sickness, though it may possibly go up as a consequence of different elements corresponding to inflation.

Individuals who enroll in conventional Medicare and a supplemental Medigap plan at 65 can anticipate to proceed paying community-rated premiums so long as they continue to be enrolled, no matter what occurs to their well being.

In most states, nonetheless, individuals who swap from Medicare Benefit to conventional Medicare don’t have as many protections. Most state rules allow plans to disclaim protection, impose ready intervals or cost increased Medigap premiums based mostly on their anticipated well being prices. Solely Connecticut, Maine, Massachusetts and New York assure that folks can get Medigap plans after the preliminary sign-up interval.

Misleading promoting

Details about Medicare protection and help selecting a plan is offered however varies in high quality and completeness. Older Individuals are bombarded with advertisements for Medicare Benefit plans that they will not be eligible for and that embrace deceptive statements about advantages.

A November 2022 report from the U.S. Senate Committee on Finance discovered misleading and aggressive gross sales and advertising ways, together with mailed brochures that implied authorities endorsement, telemarketers who known as as much as 20 instances a day, and salespeople who approached older adults within the grocery retailer to ask about their insurance coverage protection.

The Division of Well being and Human Companies tightened guidelines for 2024, requiring third-party entrepreneurs to incorporate federal sources about Medicare, together with the web site and toll-free telephone quantity, and limiting the variety of contacts from entrepreneurs.

Though the federal government has the authority to evaluate advertising supplies, enforcement is partially depending on whether or not complaints are filed. Complaints could be filed with the federal authorities’s Senior Medicare Patrol, a federally funded program that stops and addresses unethical Medicare actions.

In the meantime, the variety of folks enrolled in Medicare Benefit plans has grown quickly, doubling since 2010 and accounting for greater than half of all Medicare beneficiaries by 2023.

Almost one-third of Medicare beneficiaries search data from an insurance coverage dealer. Brokers promote medical health insurance plans from a number of corporations. Nevertheless, as a result of they obtain cost from plans in alternate for gross sales, and since they’re unlikely to promote each choice, a plan really helpful by a dealer could not meet an individual’s wants.

Assistance is on the market − however falls quick

Another supply of data is the federal authorities. It gives three sources of data to help folks with selecting considered one of these plans: 1-800-Medicare, medicare.gov and the State Well being Insurance coverage Help Program, often known as SHIP.

The SHIP program combats deceptive Medicare promoting and misleading brokers by connecting eligible Individuals with counselors by telephone or in particular person to assist them select plans. Many individuals say they like assembly in particular person with a counselor over telephone or web assist. SHIP employees say they typically assist folks perceive what’s in Medicare Benefit advertisements and disenroll from plans they had been directed to by brokers.

Phone SHIP companies can be found nationally, however considered one of us and our colleagues have discovered that in-person SHIP companies will not be accessible in some areas. We tabulated areas by ZIP code in 27 states and located that though greater than half of the areas had a SHIP web site throughout the county, areas with out a SHIP web site included a bigger proportion of individuals with low incomes.

Digital companies are an choice that’s significantly helpful in rural areas and for folks with restricted mobility or little entry to transportation, however they require on-line entry. Digital and in-person companies, the place each a beneficiary and a counselor can have a look at the identical laptop display screen, are particularly helpful for trying by complicated protection choices.

We additionally interviewed SHIP counselors and coordinators from throughout the U.S.

As one SHIP coordinator famous, many individuals will not be conscious of all their protection choices. As an example, one beneficiary informed a coordinator, “I’ve been on Medicaid and I’m aging out of Medicaid. And I don’t have a lot of money. And now I have to pay for my insurance?” Because it turned out, the beneficiary was eligible for each Medicaid and Medicare due to their earnings, and so needed to pay lower than they thought.

The interviews made clear that many individuals will not be conscious that Medicare Benefit advertisements and insurance coverage brokers could also be biased. One counselor stated, “There’s a lot of backing (beneficiaries) off the ledge, if you will, thanks to those TV commercials.”

Many SHIP employees counselors stated they might profit from extra coaching on protection choices, together with for people who find themselves eligible for each Medicare and Medicaid. The SHIP program depends closely on volunteers, and there may be typically better demand for companies than the accessible volunteers can provide. Further counselors would assist meet wants for complicated protection selections.

The important thing to creating a great Medicare protection determination is to make use of the assistance accessible and weigh your prices, entry to well being suppliers, present well being and medicine wants, and likewise think about how your well being and medicine wants would possibly change as time goes on.

This text is a part of an occasional sequence inspecting the U.S. Medicare system.

This story has been up to date to take away a graphic that contained incorrect details about SHIP areas, and to right the date of the open enrollment interval.