A brand new CPI inflation report can be launched tomorrow. However we received’t have to attend for that to witness the rising refrain of pundits and politicians who’re already declaring that value inflation doesn’t matter anymore, and the Federal Reserve should begin a brand new spherical of financial inflation and low-interest-rate coverage.

For instance, the BLS launched its newest Producer Worth Index (PPI) report right now, and costs ticked down barely, falling by 0.1 %, month over month. (PPI rose by 2.6 %, 12 months over 12 months.) The report suggests some moderation in pries, however is hardly an indication of deflation.

But, the predictable response from the same old Wall Avenue “experts” was to make use of the PPI report’s lack of sizable value inflation to demand that the central financial institution shortly enact a big lower to the goal coverage rate of interest. Why, effectively as Jeff Cox at NBC places it: “The release provides breathing room for the Federal Reserve to approve an interest rate cut at its meeting next week.” This “breathing room” is only political, in fact. Strain on the central financial institution to enact extra financial inflation has grown in latest weeks because the Trump administration has repeatedly demanded less difficult cash with a purpose to present further short-term financial stimulus. The administration additionally needs decrease rates of interest so the federal authorities can borrow more cash at decrease prices as federal deficits proceed to spiral upward underneath Trump.

Seizing upon this political “breathing room” Trump himself posted on Reality Social, ridiculously claiming there’s “no inflation” however demanding a decrease goal charge from the Fed: “Just out: No Inflation!!! “Too Late” should decrease the RATE, BIG, proper now. Powell is a complete catastrophe, who doesn’t have a clue!!!”

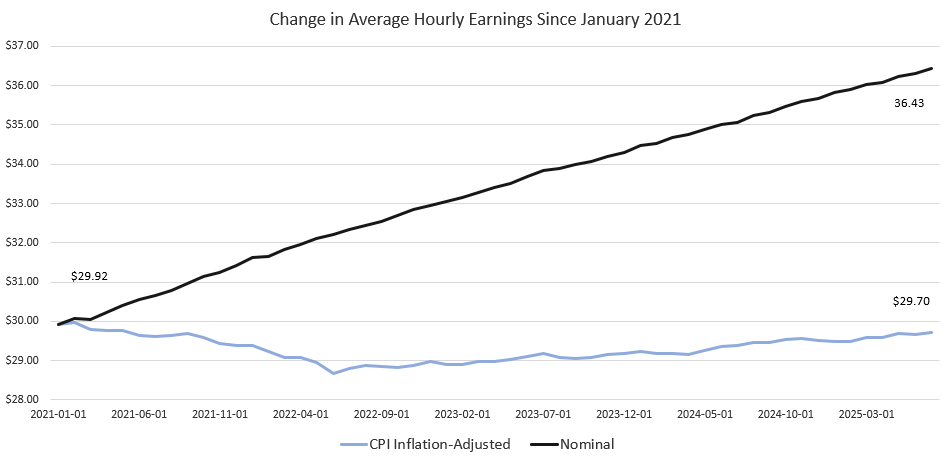

Whereas it’s simple to see why a fabulously rich man like Trump may assume there’s “no inflation”—and he subsequently needs extra financial inflation to inflate asset costs for his rich Wall Avenue pals—the truth is one thing else. For instance, since 2021, the typical hourly wage has gone down, with the latest CPI studying displaying that actual wages are usually not maintaining with the value inflation that continues to come back in effectively above even the Fed’s arbitrary two-percent goal.

Due to disastrous asset-price inflation—not correctly accounted for in CPI—for-sale houses are traditionally unaffordable as financial inflation means extra {dollars} chasing extra actual property.

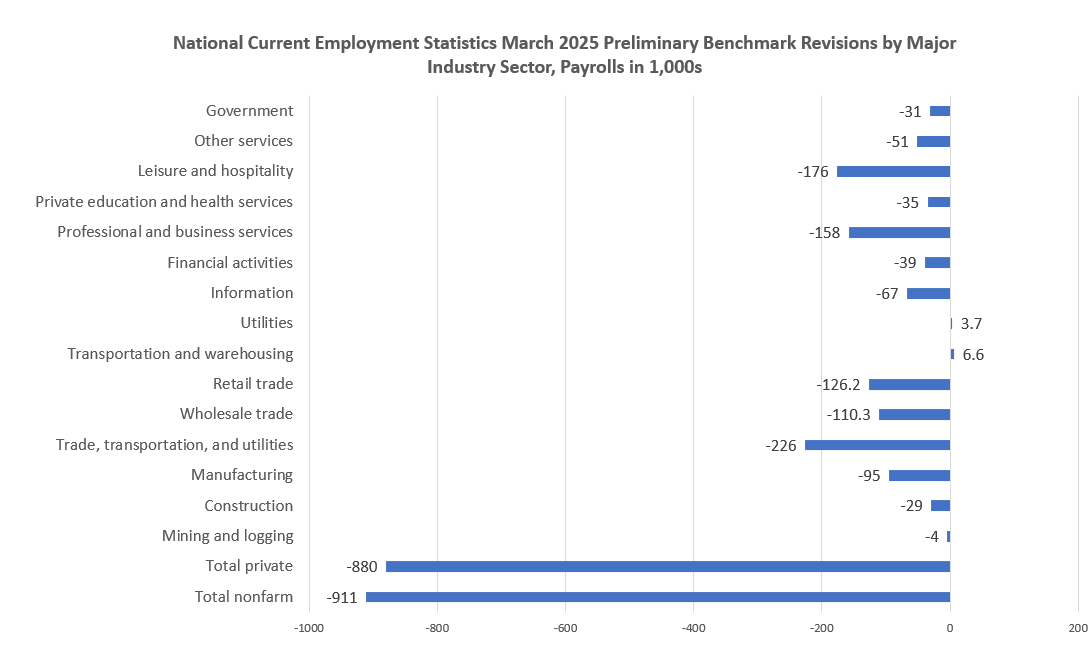

Strain on the Fed for added cuts to the goal charge additionally come from yesterday’s revelation that the BLS was inflating job-growth numbers all through 2024 and into early 2025. The BLS revised its whole job creation for the 12 months ending March 2025, reducing its estimate by greater than 990,000 jobs, slicing whole job creation by half for the interval. In different phrases, the roles financial system throughout that interval was considerably weaker than initially reported.

This has led to many requires fast and massive cuts to the goal rate of interest by the Fed—even perhaps a jumbo lower of fifty foundation factors.

So, between some slight moderation in value development, and the admission that job development is way decrease than beforehand reported, we are able to count on requires a Fed charge lower to achieve a fever pitch. The markets themselves seem to just about sure that the Fed will lower the goal charge on the FOMC assembly subsequent week.

The issue with all that is the very last thing odd folks want proper now yet one more lower to the goal charge—following final September’s untimely, pre-election lower that has ensured continued value will increase. A lower to the goal rate of interest means extra financial inflation because the Fed purchases extra belongings with newly created cash. Even when the most recent PPI and CPI information have been to indicate a complete lack of value development, what is required now’s deflation so common folks can get better a few of their misplaced incomes energy, and our bubble financial system can lastly revert to a traditional financial system constructed market demand reasonably than credit score enlargement. As I wrote final week:

Sadly, we’re unlikely to see a lot precise deflation, though it’s badly wanted. Solely deflation can return to shoppers among the buying energy they misplaced throughout the covid panic and the ensuing 40-year highs in CPI inflation that appeared throughout 2022. Deflation would additionally assist to unravel 20-plus years of easy-money fueled malinvestment and monetary bubbles. Had been this to happen, the financial system would then be rebuilt alongside extra sustainable strains that conform to precise market demand, in distinction to the easy-money financial system of speculative manias that enriches rich asset-holders on the expense of odd folks.

It’s this final level that means to us what the central financial institution will do as employment information worsens and deflationary pressures emerge: the central financial institution will intervene on the facet of rich asset homeowners to make sure that no sizable deflation in asset costs happens, guaranteeing that customers proceed to see an evaporation of buying energy whilst their job prospects disappear. We’ll begin to hear so much within the media about how the Fed is working to extend inflation with a purpose to get it again as much as the “two-percent targe” to fight “deflationary” pressures—as if deflation have been a nasty factor.

That is the alternative of what the central financial institution ought to do, which is to chorus from any additional intervention within the financial system. The Fed ought to cease shopping for belongings of any form, and permit rates of interest to be set by {the marketplace} as a substitute of by central planners on the Treasury and on the Fed. Consequently, asset costs would fall considerably, and the costs would quickly turn into extra reasonably priced. It might additionally turn into attainable once more for odd folks to earn a good quantity of curiosity on odd financial savings as rates of interest progressively rose. In different phrases, the financial system would—for the primary time in many years—start to swing again in favor or odd savers, younger employees, and first-time dwelling patrons.