My ebook “Delay, Deny, Defend: Why Insurance Companies Don’t Pay Claims and What You Can Do About It” was thrust into the highlight just lately, after UnitedHealthcare CEO Brian Thompson was shot and killed in what authorities say was a focused assault exterior the corporate’s annual buyers convention. Investigators on the scene discovered bullet casings inscribed with the phrases “delay,” “deny” and “depose.”

The unsettling echo of the ebook’s title struck me and lots of others.

That killing – and the torrent of on-line outrage that adopted – put People’ unhappiness with well being insurers on the entrance of the nationwide dialog. Many individuals responded not by mourning Thompson, however by blaming UnitedHealthcare and different insurers for failing to pay for important medical remedies. Gleeful on-line trolls even celebrated the alleged killer as a heroic vigilante.

Talking as an insurance coverage scholar, I feel few needs to be stunned by this ghoulish response. The killing revealed many People’ resentment and even rage about insurance coverage firms. And whereas the main target has been on medical health insurance, these frustrations lengthen throughout the broader insurance coverage panorama. Owners insurance coverage, for instance, is changing into tougher to get in lots of states at the same time as protection is shrinking, and auto insurance coverage charges are skyrocketing. These developments are fueling widespread discontent with insurers of all types.

Why policyholders really feel betrayed

And as I learn folks’s tales about their very own experiences, I stored listening to echoes from my ebook. Too typically, folks say, insurance coverage firms delay paying some claims, deny different legitimate claims altogether, and power policyholders to defend themselves in courtroom – all to extend earnings by reducing declare prices.

However issues typically start lengthy earlier than anybody information a declare. Insurance coverage shoppers usually don’t know a lot about what they’re shopping for. For owners, auto and lots of different sorts of insurance coverage, firms seldom present copies of coverage language or accessible summaries of coverage phrases to potential policyholders.

Insurance coverage commercials, like this one from the early Forties, typically promote the promise of security and safety.

GraphicaArtis/Hulton Archive by way of Getty Photos

Even when shoppers have entry to insurance policies, many don’t learn or can’t perceive the lengthy, advanced authorized paperwork. Equally, they will’t anticipate the numerous methods a loss might happen or the issues that might outcome if it does. Because of this, they’re solely conscious of some key phrases and in any other case consider that they are going to be “in good hands” with a “good neighbor,” to cite two of the long-lasting phrases of insurance coverage promoting.

Then, when shoppers want protection, they uncover that there are vital safety gaps. Medical health insurance can contain a tangle of limitations as a result of supplier networks, medical necessity guidelines and preauthorization necessities. Owners fairly count on that they are going to be totally coated for all main losses, however insurers have in the reduction of protection to account for rising prices as a result of inflation and local weather change.

Because of this, when catastrophe strikes, too many People really feel like they haven’t gotten the safety they already paid for.

An insurance coverage trade People can belief

Rebuilding belief in insurance coverage received’t be straightforward, but it surely’s important. Insurance coverage is the good protector of economic safety for the American center class, however solely when it really works. Because the latest response demonstrates, it must work higher. The insurance coverage trade received’t change by itself; the monetary pressures on insurers from growing losses and fierce market competitors are too nice.

To ensure that insurance coverage to serve its targets, lawmakers and regulators might want to take motion. Based mostly on my analysis, I see three large areas for enchancment.

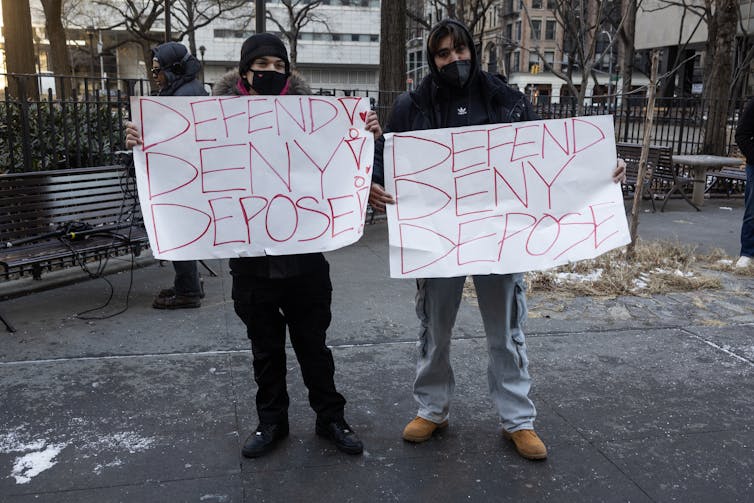

Protestors maintain indicators exterior Manhattan Legal Courtroom in New York on Dec. 23, 2024, after suspect Luigi Mangione appeared for his arraignment on state homicide expenses within the killing of UnitedHealthcare CEO Brian Thompson.

Andrew Lichtenstein/Corbis by way of Getty Photos

First, the federal government may help make the marketplace for insurance coverage work higher. Markets want info, and higher info produces higher outcomes. Regulators ought to require that key details about protection be obtainable in an accessible format for all sorts of insurance coverage.

Shoppers additionally want info on the standard of firms providing insurance policies, and whether or not an organization pays claims promptly and pretty is a key measure of high quality. Shoppers don’t have entry to a lot dependable info on that now, so disclosure needs to be mandated there as effectively.

Second, states can be clever to think about minimal protection requirements, particularly for owners insurance coverage, as insurers have been reducing again on protection just lately to cut back prices. New York addressed the same drawback in 1943, legislatively adopting a Commonplace Fireplace Coverage, since copied in lots of states.

Some 70 years later, the Reasonably priced Care Act did one thing related by requiring that insurers cowl 10 “Essential Health Benefits.” In each circumstances, lawmakers set minimal requirements that each firm should meet. States once more want to think about whether or not insurance coverage protection is just too vital to be left purely to the vagaries of the market.

Third, policyholders want efficient treatments when insurance coverage firms are discovered to have acted unreasonably. Many insurance coverage claims end in good-faith disputes about how a lot the insurance coverage firm ought to pay — for instance, whether or not roof harm was attributable to hail, which is normally coated by insurance coverage, or simply put on and tear, which isn’t. However different occasions, insurance coverage firms deny claims after insufficient investigations or for spurious causes.

For instance, a 2023 Washington Publish investigation concluded that within the wake of Hurricane Ian, some Florida insurance coverage firms aggressively sought to restrict payouts by altering the work of their adjusters who inspected broken properties. Some policyholders and their households had their Hurricane Ian claims decreased by 45% to 97%. The American Policyholder Affiliation, a nonprofit insurance coverage trade watchdog group, claimed to seek out “compelling evidence of what appears to be multiple instances of systematic criminal fraud perpetrated to cheat policyholders out of fair insurance claims.”

A cellphone photograph exhibits the broken dwelling of retired couple Terry and Mary Sebastian, whose story was featured in a 2023 Washington Publish investigation.

Thomas Simonetti/Washington Publish by way of Getty Photos

When folks discover themselves on this kind of scenario, they must spend a number of effort and time preventing to get what they have been owed within the first place. Even when an insurance coverage firm finally relents, it nonetheless hasn’t fulfilled its unique promise to the policyholder to settle claims promptly and pretty. In these circumstances, requiring extra compensation to policyholders and insurer disincentives for unreasonable conduct would degree the taking part in subject.

The deep resentment many People really feel towards insurance coverage firms grew to become obvious after the killing of Brian Thompson. Reforms comparable to these can be a significant response to that resentment.