Earlier this month, we checked out June’s CPI numbers and located that, but once more, the federal government’s personal price-inflation information reveals costs proceed to develop above the central financial institution’s two-percent inflation goal. As I reported on July 15, June’s CPI development charge was the biggest year-over-year improve in 4 months, and the biggest month-to-month improve since January 2025. June’s CPI improve additionally locations CPI development above of CPI development charges skilled throughout September of final 12 months. At the moment, Fed Chairman Jerome Powell had declared that worth inflation was quickly shifting again towards the Fed’s two-percent goal. 9 months later, we will see the Fed’s forecasters have been clearly incorrect, because the CPI has elevated by 2.1 p.c in that interval.

An identical pattern additionally confirmed up in so-called “core CPI” which removes unstable meals and power costs. Core CPI additionally hit a four-month excessive in June, measured year-over 12 months. Measured month-to-month, core CPI hit a 5 month excessive in June.

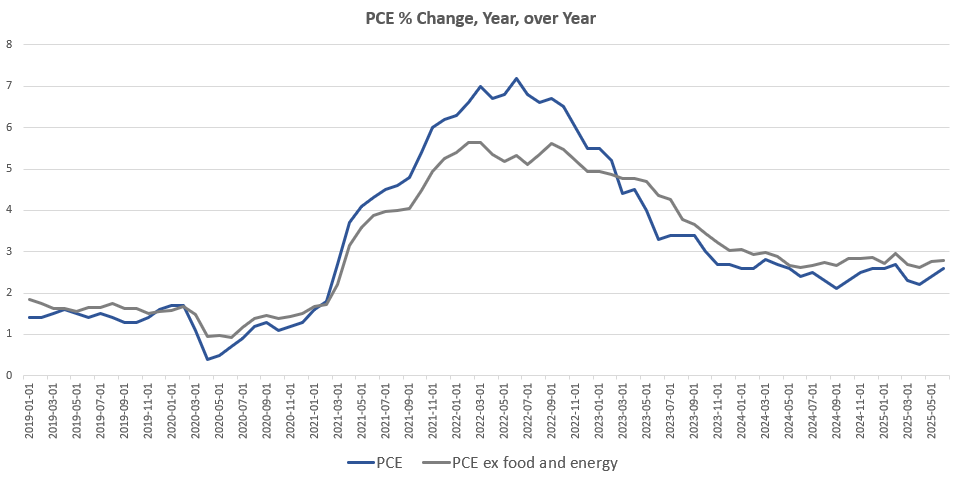

The Fed’s most well-liked measure of price-inflation, nevertheless, is the PCE (private consumption expenditure) measure, and in a brand new information launch Thursday morning, the BLS reviews that PCE worth inflation is heading upward, as effectively. In June, PCE elevated by 0.3 p.c, month over month, and that’s the biggest month-to-month improve since February. Actually, the month-to-month PCE development has gotten bigger every month since February. The identical is true of PCE excluding meals and power.

Trying on the PCE change, 12 months over 12 months, we discover a comparable pattern. Throughout June, PCE development was up by 2.6 p.c, 12 months over 12 months. That’s up from Could’s development charge of two.4 p.c, and June’s development is the biggest since February. PCE development minus meals and power additionally got here in at a four-month excessive, rising to 2.8 p.c (or 2.79 p.c), up from Could’s measure of two.75 p.c. Regardless of the Fed’s assured claims about worth inflation falling to the two-percent goal final fall, month-to-month PCE development has modified little since April of 2024.

After all, it’s seemingly that the Fed by no means actually believed that worth inflation was decelerating in any respect. Quite, at the moment, Powell and the Fed merely wanted one thing to justify the Fed’s September lower to the coverage rate of interest. The Fed wanted some method to clarify away what was nearly definitely a cynical effort to stimulate the economic system for the advantage of the incumbent political occasion.

June’s troubling numbers on worth inflation do assist clarify why Powell and the FOMC have been so reluctant to chop the coverage rate of interest but once more, regardless of repeated calls for from the President. The FOMC once more declined to decrease the coverage charge earlier this week at its July assembly. Powell is correct to be involved {that a} dovish flip from the Fed would gas much more PCE inflation, and will additionally gas rising yields in long-dated Treasurys.

.png?w=1920&resize=1920,0&ssl=1)