June’s job losses—which now are available in at -13,000—had been then adopted by a achieve of an unimpressive 79,000 in July, with the brand new August complete coming in at a paltry 22,000. Whole job good points have now averaged a measly 29,000 for the previous three months. This all suggests a quickly weakening job market.

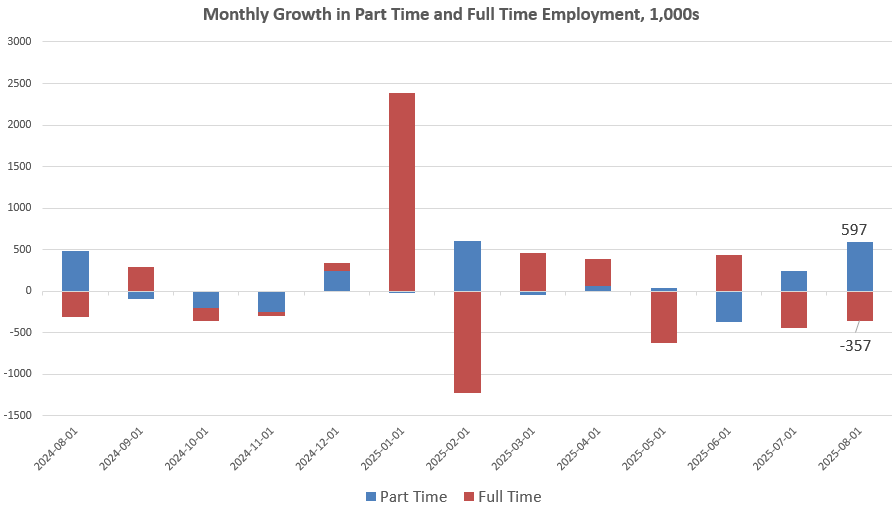

Another excuse for concern is the truth that what job progress we have now seen within the family survey has been due more and more to half time employment. That is often an indication of a weakening labor market. Particularly, for August, complete full-time employment decreased by 357,000, in comparison with July. On the similar time, part-time employment elevated by 597,000. Over the previous three months, full-time employment has fallen by a median of 360,000 jobs monthly, whereas part-time has elevated, on common, by 477,000.

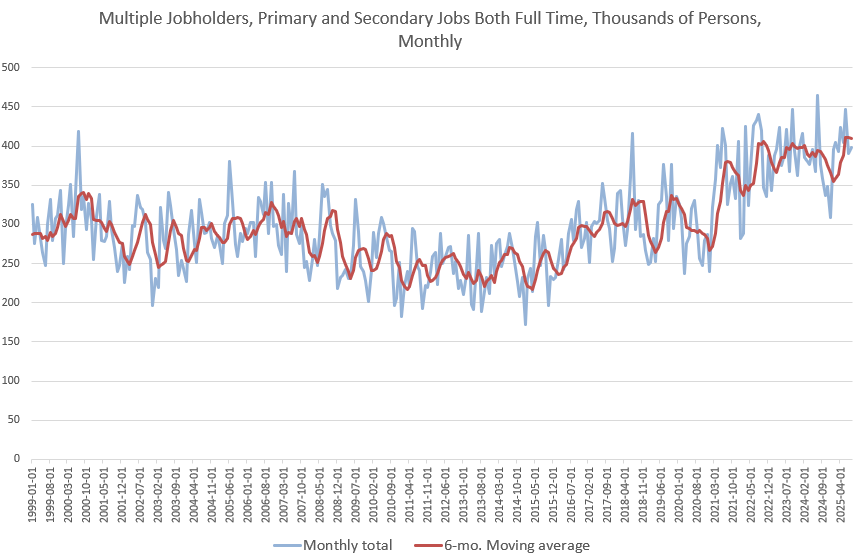

We shouldn’t be shocked, then, to seek out that increasingly more staff are holding down multiple part-time job to make ends meet. Notably, the whole variety of a number of job holders with two or extra part-time jobs has been trending upward since 2021, and now sits close to (at the very least) a 30-year excessive.

This additionally helps to clarify the discrepancy between the institution survey and the family survey. The institution survey contains part-time jobs, whereas the family survey measures employed individuals. There are extra jobs on the market than there are employed individuals, however these employed individuals are more and more having to depend on holding down greater than one of many half time jobs within the institution survey.

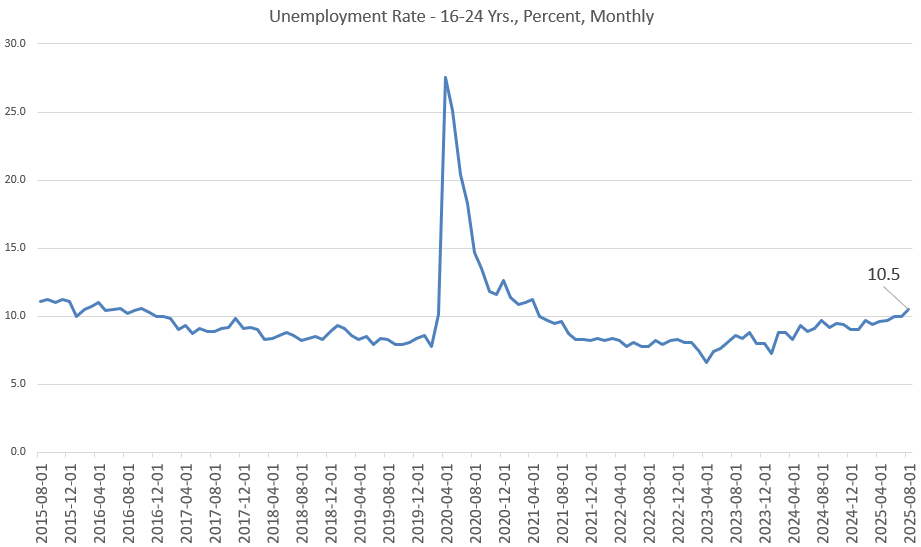

The stagnation in complete employment can also be fueling growing unemployment. Yesterday, we checked out how the whole variety of unemployed individuals (within the July knowledge) exceeded the variety of job openings for a similar interval. I predicted this is able to translate right into a rising unemployment fee, and right this moment’s knowledge launch reveals this. The unemployment fee in August rose to 4.3 %, which is the very best since October 2021. That’s being fueled partly by quickly rising unemployment amongst younger individuals. I discussed yesterday that current faculty graduates at the moment are experiencing greater unemployment than all staff general. Now, we discover that that, for August, the general unemployment fee for staff ages 16-24 years, rose to 10.5 %. That’s the very best since April 2021. Excluding the covid interval, we have now to go all the way in which again to July 2016 to discover a greater unemployment fee for that age group.

In the meantime, the whole variety of unemployed individuals in August rose to 7.38 million, the very best since September 2021. The variety of discouraged staff additionally elevated once more in August, rising to 1.79 million.

What Will the Coverage Response Be?

The employment numbers are so dangerous that President Trump has not commented on them as of this writing, and the White Home has issued no press launch on the subject.

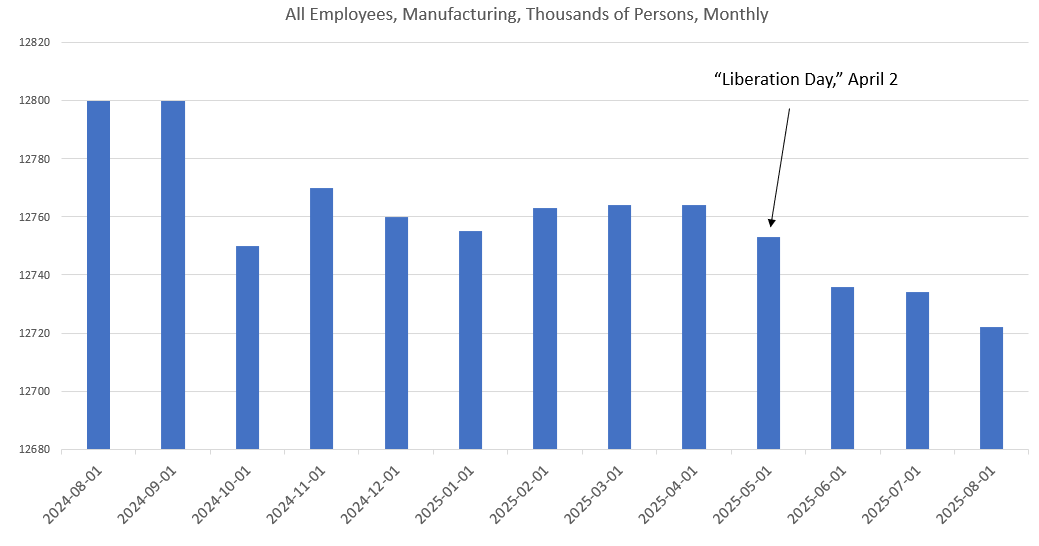

The administration could also be exhausting at work making an attempt to provide you with some clarification for why the administration’s flagship coverage of elevating taxes (i.e., tariffs) on tens of millions of People hasn’t produced a boon in new employment. Certainly, the promised renaissance in manufacturing jobs—that was to be fueled by protectionist tariffs—has not materialized. Since April, when Trump introduced “liberation day” and hiked new tariffs, the US has misplaced 42,000 manufacturing jobs.

Alternatively, the continued decline within the job market will assist Trump in his repeated requires extra financial inflation from the Federal Reserve within the identify of stimulating job progress. Value inflation stays effectively above the Fed’s goal fee of two %, and this has fueled resistance on the FOMC to additional forcing down the goal coverage rate of interest.

With these newest jobs numbers, although, it’s doubtless the Fed will wish to be seen as “doing something” for the job market and now the Fed is way extra prone to implement one other discount to the goal rate of interest. This can additional add to the historic flood of financial inflation that has fueled new bubbles in asset costs, and has contributed to the greenback shedding practically 25 % of its buying energy over that interval.

Even with a further enhance to financial inflation, although, it’s attainable we’ll see moderation in worth inflation (i.e., CPI inflation). As staff change into unemployed or underemployed in bigger numbers, they’ll have fewer {dollars} to bid up costs in lots of areas measured by the CPI basket of products. That’s, staff should reduce on purchases of meals, gasoline, and associated on a regular basis items. Rising unemployment may also put downward strain on house costs. Even when mortgage charges fall, unemployed staff can’t make mortgage funds, no matter how low charges may fall.

Sadly, we’re unlikely to see a lot precise deflation, though it’s badly wanted. Solely deflation can return to customers a few of the buying energy they misplaced in the course of the covid panic and the ensuing 40-year highs in CPI inflation that appeared throughout 2022. Deflation would additionally assist to unravel 20-plus years of easy-money fueled malinvestment and monetary bubbles. Have been this to happen, the financial system would then be rebuilt alongside extra sustainable traces that conform to precise market demand, in distinction to the easy-money financial system of speculative manias that enriches rich asset-holders on the expense of strange individuals.

It’s this final level that means to us what the central financial institution will do as employment knowledge worsens and deflationary pressures emerge: the central financial institution will intervene on the facet of rich asset house owners to make sure that no sizable deflation in asset costs happens, guaranteeing that buyers proceed to see an evaporation of buying energy at the same time as their job prospects disappear. We’ll begin to hear loads within the media about how the Fed is working to extend inflation with the intention to get it again as much as the “two-percent targe” to fight “deflationary” pressures—as if deflation had been a foul factor.

That is the other of what the central financial institution ought to do, which is to chorus from any additional intervention within the financial system. The Fed ought to cease shopping for belongings of any type, and permit rates of interest to be set by {the marketplace} as a substitute of by central planners on the Treasury and on the Fed. In consequence, asset costs would fall considerably, and the costs would quickly change into extra inexpensive. It might additionally change into attainable once more for strange individuals to early an honest quantity of curiosity on strange financial savings as rates of interest regularly rose. In different phrases, the financial system would—for the primary time in many years—start to swing again in favor or strange savers, younger staff, and first-time house patrons.

Sadly, the Trump administration vehemently opposes any such change and can demand that the central financial institution intervene to additional assist Trump’s Wall Road allies.