On the call, which lasted 90 minutes, Senator Chuck Schumer of New York, the majority leader, told Democrats that he planned to press forward with votes next year, saying, “We won’t stop working on it until we pass a bill,” according to one official.

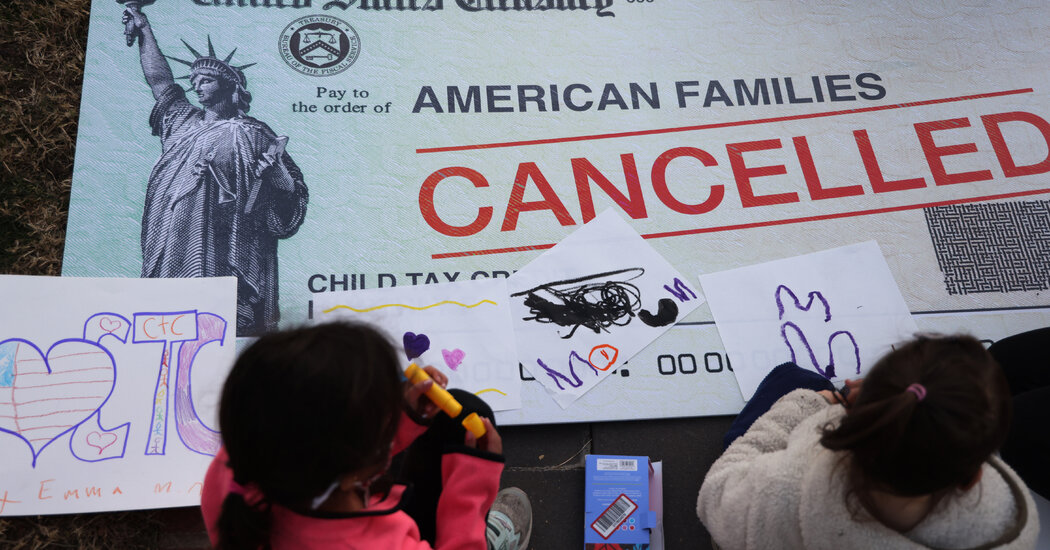

Congress expanded the scope of the child tax credit through the end of the year as part of the $1.9 trillion pandemic relief law, which cleared Congress with just Democratic votes, including Mr. Manchin’s. Democrats hope to extend it and ultimately make it permanent.

The credit, first established in the late 1990s, was increased to cover more families and restructured to allow direct monthly payments this year of up to $250 a child, or $300 for a child under 6. It also became fully refundable, meaning families did not need to provide proof of income or owe federal income tax to receive the payment.

Of the country’s 74 million children, nearly nine in 10 qualified, and the expanded eligibility for families at the low end of the income scale significantly reduced child poverty.

In an October Census Bureau report that tracked how about 300,000 recipients spent their first three payments this summer, researchers found that about half of families spent part of the money on food. Other families said they used the money to help pay their rent, mortgage, utilities, child care and school expenses.

Under the version of the domestic policy bill passed by the House, the program would be extended by another year. Without an extension of the expanded program, the size of the credit will fall substantially, especially for low-income families. And it will revert to being paid in a once-a-year lump sum connected to filing a tax return rather than half of it distributed monthly.

As Democrats hailed the payments hitting their constituents’ bank accounts this year, Mr. Manchin balked at the cost of the one-year extension, arguing that it was misleading given that there were ambitions to make it permanent, a step that would cost about an additional $1.5 trillion over a decade, according to the Congressional Budget Office.