The U.S. Supreme Court’s recent decision in SEC v. Jarkesy could profoundly impact the cryptocurrency industry by redefining how the SEC enforces regulations. Although the case doesn’t directly involve cryptocurrencies, it limits the SEC’s ability to use administrative proceedings for imposing penalties, forcing enforcement actions into federal court. This shift could have wide-ranging implications for crypto companies, investors, and the broader regulatory landscape.

A Landmark Decision: What is SEC v. Jarkesy?

The case originated when the SEC investigated George Jarkesy and Patriot28 for alleged securities fraud. Between 2007 and 2010, Jarkesy launched two investment funds, raising approximately $24 million from 120 accredited investors. The SEC accused Jarkesy of violating antifraud provisions under major securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934, seeking penalties through internal administrative proceedings.

In a landmark decision, the Supreme Court ruled that using in-house hearings to impose civil penalties violates the Seventh Amendment, which guarantees the right to a jury trial. As a result, the SEC must now bring such enforcement actions in federal court.

This decision introduces a fundamental change in how regulatory agencies like the SEC operate, creating ripple effects for industries far beyond traditional securities markets.

Ripple Effects: The SEC and Cryptocurrency Regulation

The implications of this decision are particularly significant for the cryptocurrency sector, where regulatory clarity has been a long-standing challenge.

1. Reduced SEC Enforcement Power

The ruling weakens the SEC’s ability to act swiftly through administrative proceedings. According to a 2023 report by Cornerstone Research, the SEC brought 46 enforcement actions against digital asset market participants, with 20 handled through administrative proceedings. This ruling will likely slow the enforcement process, especially as jury trials in federal court are resource-intensive and time-consuming. Smaller companies may view this as an opportunity to contest enforcement actions, while the SEC’s overall deterrent effect may diminish.

2. Increased Legal and Financial Challenges for Crypto Companies

With the enforcement burden shifting to federal courts, crypto firms could face prolonged and expensive litigation. Companies with substantial legal resources may gain an edge, while smaller firms could struggle to comply with evolving regulations and heightened legal scrutiny.

3. Heightened Regulatory Ambiguity

This decision adds to the uncertainty surrounding cryptocurrency regulations. Without a streamlined administrative process, enforcement actions may become inconsistent, leaving companies in a gray zone about compliance expectations.

4. Potential Impact on Investor Confidence

Regulatory ambiguity and prolonged litigation could deter investors from entering the crypto market. This hesitation could negatively impact cryptocurrency prices and market stability, as investors seek safer alternatives until clearer regulations emerge.

A Broader Legal Context

The Jarkesy ruling is part of a larger trend of judicial scrutiny over regulatory agencies’ authority. It reflects growing concerns about due process and checks on executive power. This case could inspire challenges to similar practices in other agencies, such as the Commodity Futures Trading Commission (CFTC), which also oversees parts of the crypto market.

Internationally, regulators may either emulate this precedent or take a more centralized approach to avoid similar constraints. For instance, countries in the EU might adopt more comprehensive frameworks to ensure faster regulatory actions.

The SEC’s Role in Combating Fraud

Despite the ruling’s limitations, clear and enforceable regulations remain vital to combating fraud and protecting investors. The SEC’s initial investigation into Jarkesy focused on alleged securities fraud and misleading practices—issues that are equally relevant in the cryptocurrency space. Striking a balance between robust enforcement and fair legal processes is essential to maintaining market integrity.

Navigating the New Normal: Practical Insights for Crypto Stakeholders

To adapt to this evolving landscape, cryptocurrency companies and investors should consider the following steps:

- Prepare for Litigation: Allocate resources for potential federal court battles and seek expert legal counsel to navigate complex cases.

- Enhance Compliance: Stay updated on regulatory changes and implement strong internal controls to avoid enforcement actions.

- Engage in Policy Advocacy: Work with industry groups and policymakers to advocate for clear and balanced regulations.

- Focus on Investor Education: Build trust by educating investors about the implications of regulatory changes and ensuring transparent operations.

Future Outlook: What Lies Ahead?

The Jarkesy ruling could significantly shape the cryptocurrency landscape over the next decade:

- Decentralized Finance (DeFi): As DeFi grows, enforcement may shift toward protocols rather than individual companies, creating unique challenges.

- Legislative Responses: Congress may pass new laws to address the gaps created by this decision, potentially providing clearer guidelines for crypto regulation.

- Global Trends: Countries with stricter enforcement mechanisms may attract crypto firms seeking regulatory certainty, altering the global competitive landscape.

Conclusion: A New Era of Enforcement

The SEC v. Jarkesy decision marks a pivotal moment for cryptocurrency regulation. While it limits the SEC’s enforcement power, it also underscores the need for balanced and transparent legal processes. For crypto companies, this ruling presents both challenges and opportunities to shape the regulatory environment proactively.

As stakeholders adapt to this new reality, one question remains: What will the future of cryptocurrency enforcement look like? Share your thoughts and join the conversation below.

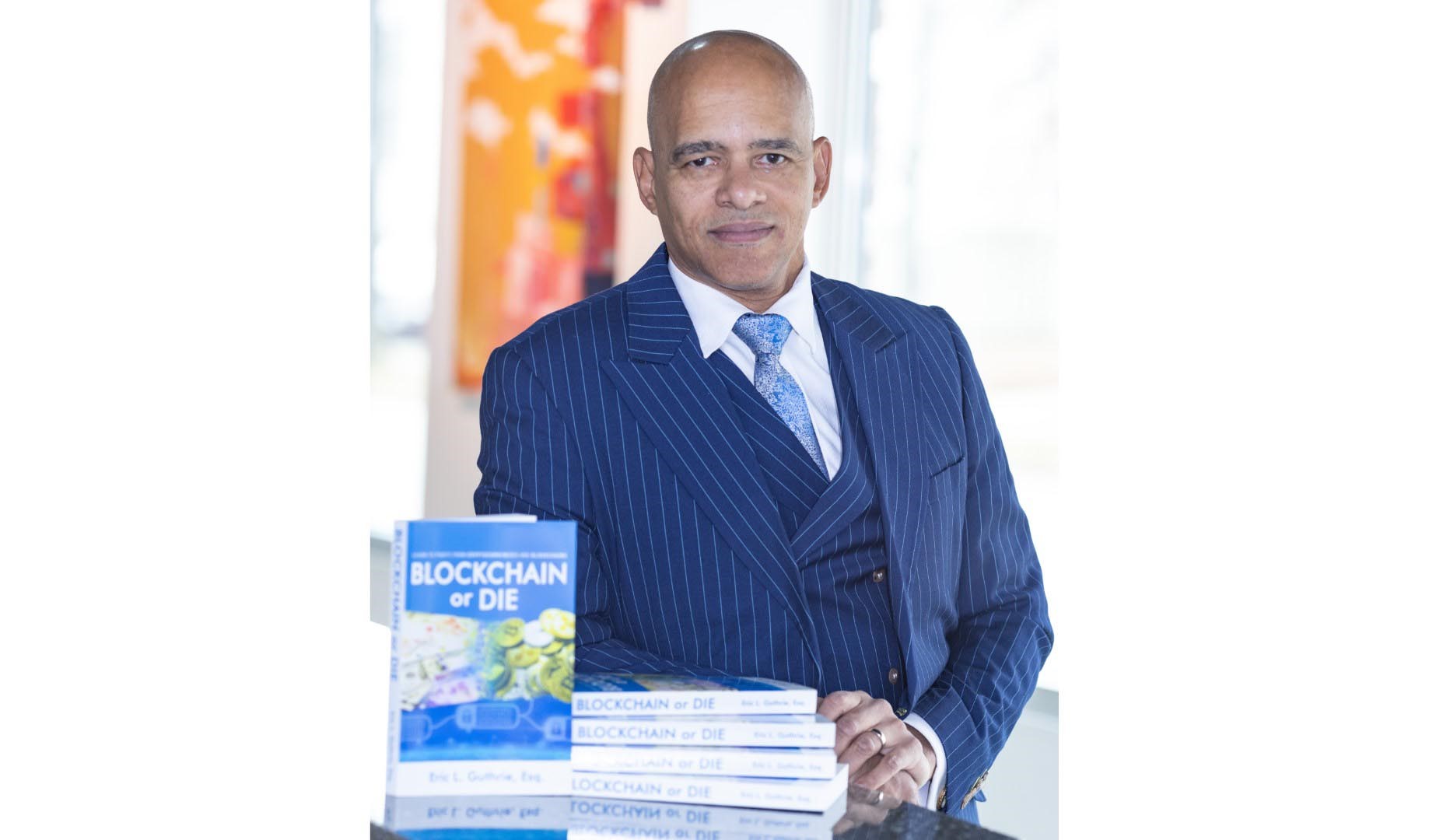

About the Author

Eric Guthrie is a best-selling author, blockchain attorney, and global trainer dedicated to advancing blockchain technology and cryptocurrency education. As the Director of Training Programs for the Government Blockchain Association and a Partner at The Cogent Law Group, Eric has guided organizations worldwide in navigating the evolving regulatory landscape. He is the author of Blockchain or Die and Diversify or Die and serves as President and CEO of Better ME Better WE, a global training and consulting company.